There were nice setups in both the EUR and GBP during the UK session. I will show the EUR trade which was very straightforward and required a much smaller stop loss. The GBP is moving considerably more than the EUR at the moment, so a larger stop loss with the right setup is fine.

A question you need to always ask yourself before taking any trade is: what is the reward potential for the amount of risk that I’m willing to take in this trade?

I like a 3:1 RR ratio early in the session and 2:1 RR is fine once the US traders are active.

Another question to ask: is the pair trending nicely or is it difficult to determine its current direction?

The GBP trend is less clear this week than last, and the EUR is very clearly trending down.

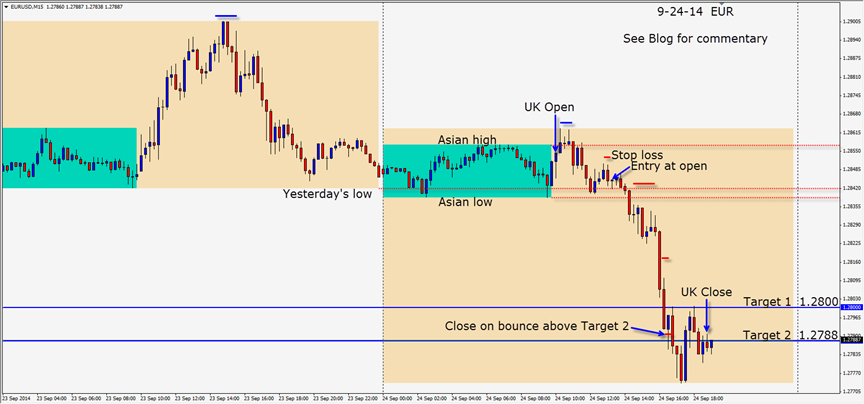

We see the EUR ran into sellers above the Asian session highs and began to move down. The German Ifo Business Climate number missed expectations and as we moved into the “sweet spot” of the session, a new lower high forms and gives us an entry short with a 8:1 RR ratio.

To recap, we have a trending pair, a nice setup, negative German economic news, a cheap stop loss, lower highs and a high potential for reward at a time in the session when intraday trending moves frequently occur. The daily candle’s close was extremely bearish.

Once Target 2 is hit, I am only willing to give back a few pips most days before closing a trade…so on the bounce above – we exit and move on. Once price makes it to Target 2 – which is statistically significant, it is more likely to bounce, as it has made it range for the day.

The idea is to look for a reversal at this level…enter and place a stop loss below T2. This is an advanced technique but it works nicely going into the UK Close.

Be mindful of price action at the 1.2750 level. Anticipate more institutions adding to their short positions on bounces approaching the 1.2900 figure.

Good luck with your trading!

If you want to learn more about institutional trading techniques and how to spot setups that occur most days, enquire about my course – but it’s not cheap. If you are struggling to be successful trading, please don’t use real money!

Back tomorrow if we find a trade.