The main risk event of the week is the ECB Press conference on Thursday. What will Mario Draghi say this time and will it be enough? Institutional position sizing will remain light in the meantime.

It is not unusual to see clear trends from the previous year become cloudy in January. What is highly unusual is having a Central Bank completely surprise the market with an abrupt about face from their comments the week before. I won’t mention any names.

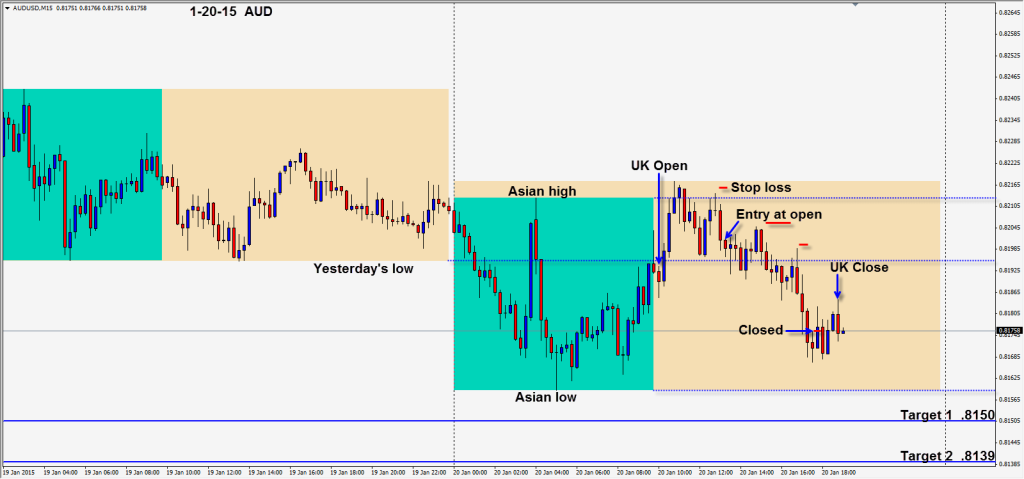

As the market digests the news and USD trending strength took a hit, albeit temporarily, a short setup is found in the oscillating Aussie dollar.

As price ran into sellers above the Asian high and closes back into the Asian range with a lower high – a short is taken. With a stop loss of 14 pips and our Target 2 60 pips away, we like the setup… preferring to trade with the larger trend. Price moves lower but stalls near yesterday’s low. When price breaks through yesterday’s low, we tighten our stop loss. As price breaks solidly toward the Asian lows, long lower wicks appear… indicating buyers entering. We tighten our take profit and the market closes us out.

Be extremely careful trading this week and keep your stop losses tight. Money management is fundamental to trading success.

Good luck with your trading!

Back when we see something we like.