When the majors are moving in sync, trade in the direction of either USD weakness or strength. I prefer to trade the pair where I can find the smallest stop loss…all things being equal. Rarely, however in trading are all things equal. The GBP could be having a particularly active week and the EUR could be having a more subdued week than usual or the commodity pairs may be very active on a given day.

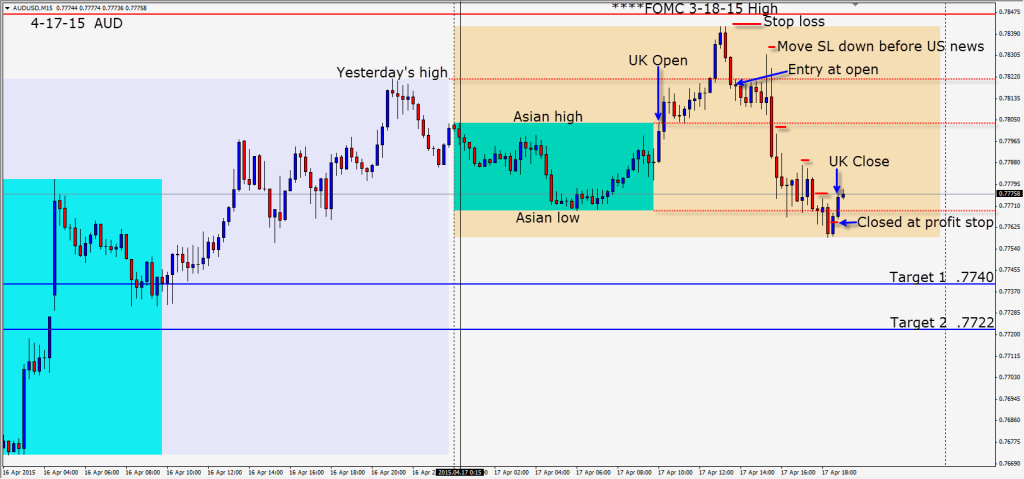

In today’s session, my first choice would have been the EUR, then the GBP, but the AUD had the least expensive stop loss when placed above structure.

A short is taken at a time of day when we often see large trending session moves. It was not the case today… as the market went sideways after the entry until the US session news. A bit of volatility in advance of the U.S. news made it prudent to move the initial stop loss down… as more negative U.S. numbers would completely reverse the market.

The AUD was unable to take out the technically significant daily high from the March 18th FOMC which made the choice to short the AUD more compelling. When the pair started falling we tightened our take profit to about halfway up any large candles or above structure. Price moved down but was unable to stay below the Asian lows and we are taken out near the UK close.

Next week is light in the way of U.S. economic news releases. It will be interesting to see how the market reacts while it awaits further indication as to the US economy’s strength. In the meantime, we have the Greek situation affecting the EUR and the UK pending elections affecting the GBP. Oil has strengthened this week and the Canadian economy is looking better than expected. Australia and New Zealand have also posted good numbers this week. The JPY is currently comfortable below 121.00.

Enjoy your weekend!

Back Tuesday if we find a trade.