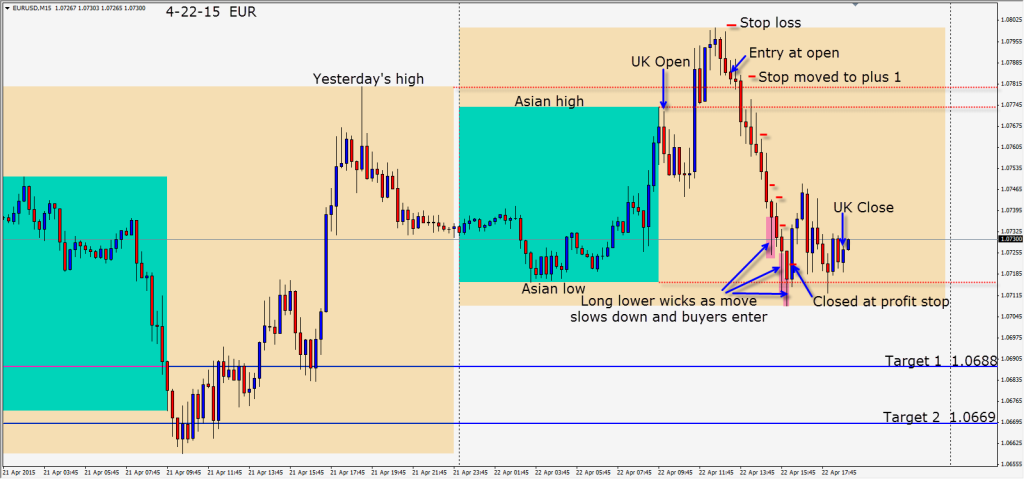

USD strength re-emerges as the EUR was unable to close above 1.0800 and began to move downward. A short setup is found with a 16 pip stop loss placed above the session highs, for a potential 116 pips to our Target 2.

As price picks up momentum to the downside we can see the long upper wicks on the candles. As price begins to lose downside momentum, we can see long lower wicks on the candles. Vertical moves are not sustainable. When buyers are entering and long lower wicks are appearing on the candles, the idea is to tighten up the profit stop – to lock in as many pips as possible. Think of the long lower wicks as the brakes being applied to the move. Price made it to the Asian session lows but could not close beneath it.

We had 3 candles essentially waving red flags at us and the fourth candle (the blue one) takes us out at our tightened profit stop. Although we did not make it to our Target 1 and 2, we captured a large piece of the daily move.

Tomorrow’s session has some significant economic news releases.

Good luck with your trading!

Back tomorrow if we find a trade.