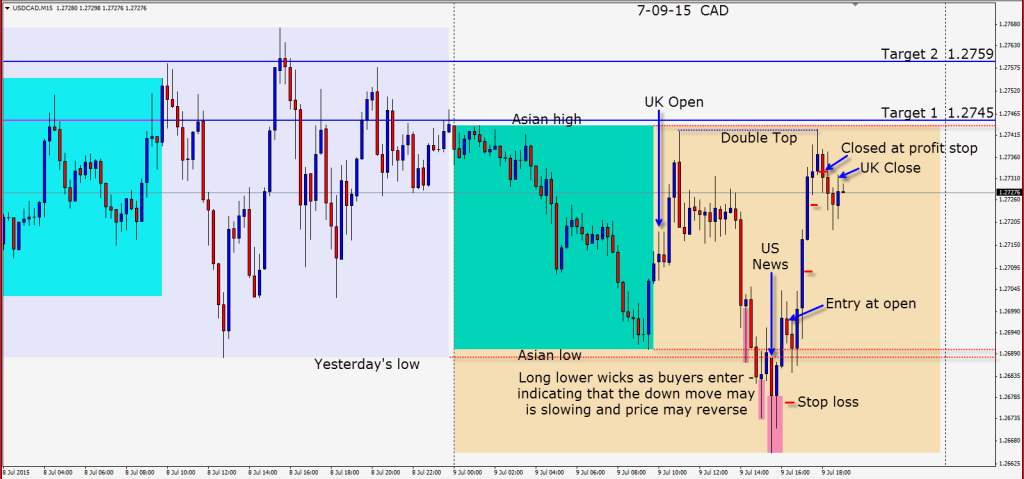

This is a trade from Thursday, not today.

An hour before the U.S. Open the USD begins to fall against the Canadian dollar. As price reaches both the Asian session low and yesterday’s low, buyers enter leaving a very long lower wick. Price pushes down and closes at the Asian session low, then manages to close below yesterday’s low. As the US session gets underway, we see another long lower wick and price tries to climb above both yesterday’s low and the Asian session low.

Despite a disappointing U.S. Unemployment Claims number and WTI moving up – the USD catches a bid tone. As it closes strongly above the Asian session low, we enter long with a 20 pip stop loss for a potential 62 pips to our Target 2.

Price retests the Asian session low, then begins to move higher. As it does …we tighten our profit stop and watch a full reversal unfold. As price makes a Double Top for the session and is showing long upper wicks, denoting sellers entering… our tightened profit stop is hit.

This is a classic example of “trade what you see…not what you think”. It seemed odd that after a disappointing unemployment release and WTI bouncing upward that the USD would strengthen to the CAD as it did.

The Greece situation will continue to unfold this weekend. The EUR 110.00 Big Figure remains significant to any larger downside move. Be very cautious around this area.

Today, I couldn’t find any trade setups that I liked. Congratulations if you did.

Good luck with your trading and enjoy your weekend!

Back Monday to check in on the Greece/ECB impact to the markets and will post if a trade is found that we like.