The institutions continue to expect dovish comments from ECB President Draghi and he continues to deliver. The EUR daily chart indicates short is the direction and this may pick up momentum once 1.1100 gives way. It is to the ECB’s advantage to have a weaker EUR and the market tends to oblige – particularly when it is not focused on China.

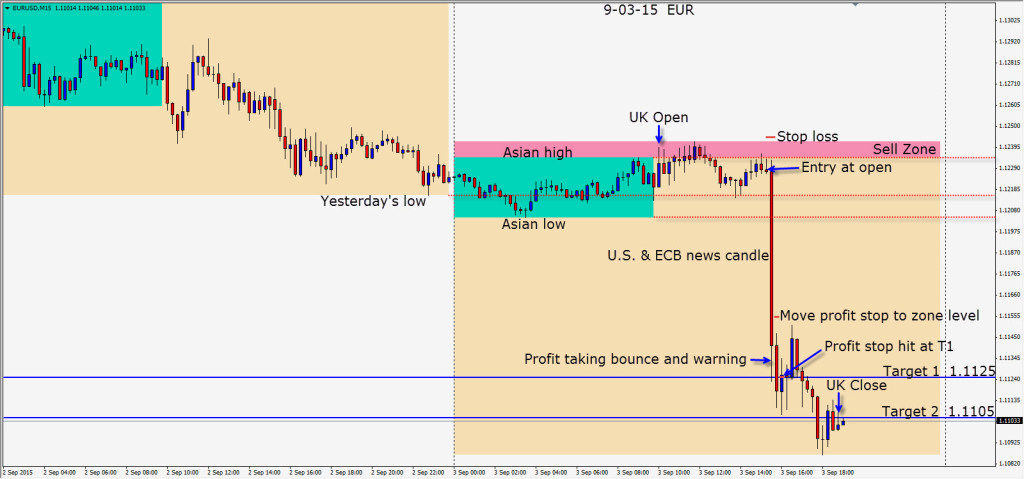

A very clear sell zone was evident above the 1.1234 area and it held well throughout the Asian session. As the combination of Draghi’s press conference with the U.S. Unemployment Claims number and Trade Balance all due, the market was quite subdued while awaiting the outcome. A stop loss just above the day’s high cost 17 pips. Our Target 2 was 121 pips away. Although always risky entering before news, with the very defined sell parameters from the larger charts and an excellent reward to risk ratio, a short is taken with the trend.

We are quickly rewarded and note the profit taking bounce at Target 1. As price drops further we tighten our profit stop in hopes of getting to Target 2. Price begins to move upward and we are taken out of the trade. The 1.1100 area provided a triple confluence today and we expected a rebound had we attained it.

For those watching WTI – it once again set up beautiful trades in the USDCAD and CADJPY today.

Tomorrow is NFP Friday with all FED watchers on deck. Be very careful as the volatility will likely be very high. The easier move to catch is usually the reversal after the initial reaction to the print fades. Never chase a trade.

Good luck with your trading!