I’m including two days of trades today due to a tech glitch yesterday that prevented me from getting Wednesday’s trade posted.

Let’s start with today. What a week and we still have the NFP number to be revealed tomorrow. ECB President Mario Draghi had everyone’s attention today when he made his speech. The EUR after nearly touching 1.05 earlier in the session, jumped well above 1.09. This will take out a lot of stops, but the trend remains down…so let the buyer beware. Janet Yellen has been hawkish and continues to reiterate her case for seeing interest rate liftoff being imminent.

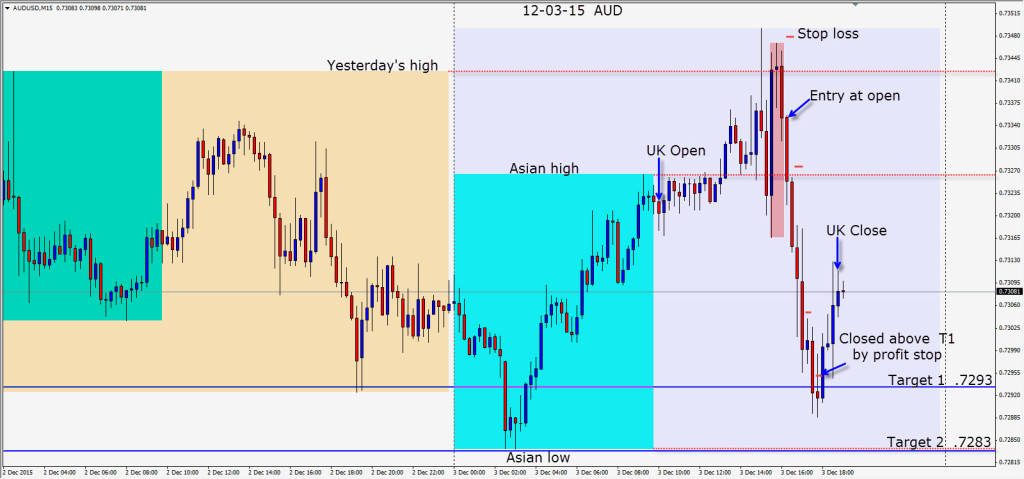

Remaining on the sidelines until after Mario Draghi’s comments and not chasing anything led me to the AUD which I prefer to short currently. Although the AUD has been strong this past month, I will be more convinced if it can close above .7380 and then take out .7460 near-term. In the meantime, when the setup presents itself with the appropriate reward to risk, I prefer to short its rallies.

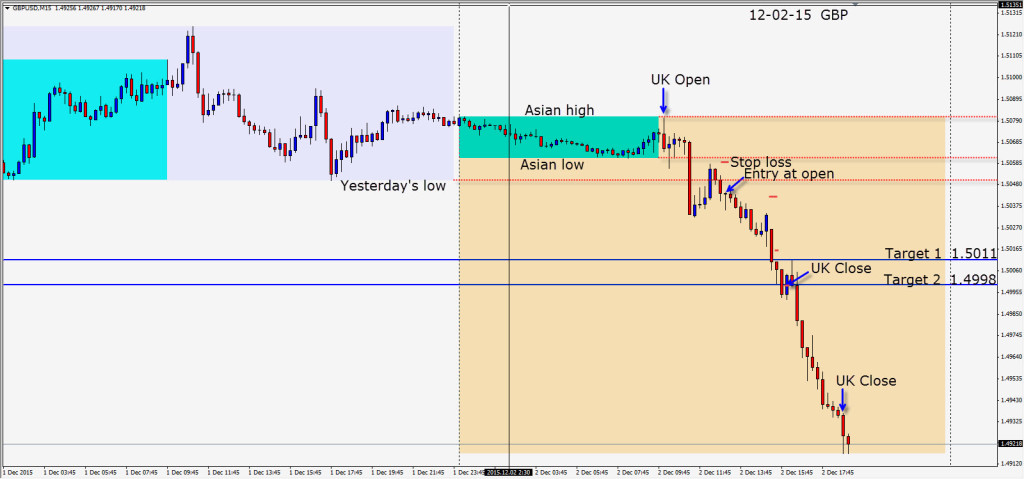

Yesterday was a different story. It’s highly unusual to see a really large move without news and before Janet Yellen spoke, the GBP hit our targets and then took off as “real money” accounts pushed it lower still. We left a 100 pips on the table by protecting our Target 2…oh well.

After a second lower high for the session an entry short is taken with trend. As price moved lower and dipped below our Target 2, we protected our profits by locking them in at T2 and we were closed near the important 1.5000 big figure. Who knew? Price retested the level and dropped another 100 pips… all before Janet Yellen’s speech…very unusual.

For me, the trend has not changed and will reasserts itself in the near term. I remain USD bullish for now and look for setups to trade accordingly.

Stepping aside as usual on NFP Fridays and will be back Tuesday if we find a trade.