Last week I showed USDCAD trades. Today I will show a CADJPY trade which is also a proxy for oil currently. The EURCAD is making great moves too while oil is volatile. Find the best setup in a pair that you are comfortable with and look for the best R/R and/or the nicest chart.

Oil was moving up above $30 last week and is moving down to test $30 this week.

The large percentage moves in oil each day reflect in the USDCAD and the CAD crosses.

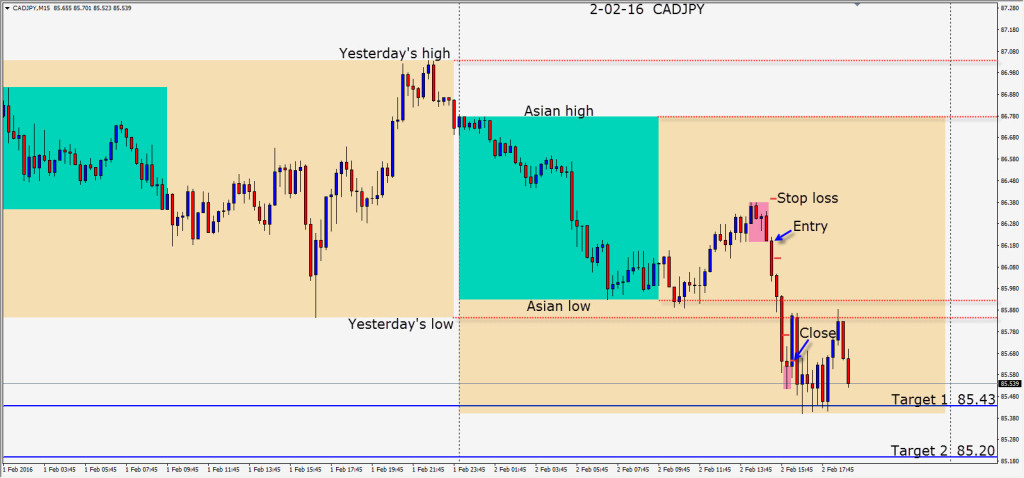

Today as the US session got underway… oil continued lower and the CADJPY dropped with it. If you look at the USDCAD it began upward and with the USDJPY moving downward…a CADJPY short is going to present itself… and it did. With a small 19 pip stop loss and a potential 100 pips to our Target 2…we have a very nice R/R trade setup with confluence.

The risk was taken out of the trade after the first candle closed. Price moved down through the Asian low and yesterday’s low…initially without a retest. As price moved lower we got a wicky bottom as buyers began to enter. We tightened our profit stop to the close of the previous candle and the market takes us out. Equivalent trade setups were in the USDCAD and EURCAD for those that like taking advantage of oil’s volatility.

The $30 level for oil is currently very telling. If it closes below it, I suspect it may retest the low from January 20th near term…where buyers emerged beneath $28.

Use prudent money management and tight stops! Be aware of the context of the market and trade what you see!

Good luck with your trading!

Back tomorrow if we find a trade.