I’m back from taking a week off from postings. It is the middle of the summer and it’s nice to do other things too…like being outside.

The market last week was focused on the FOMC statement, the BOJ Outlook and finally a poor U.S. GDP number. The bank stress tests over the weekend for Europe apparently passed, but some of largest European bank stocks are cratering. If any of this inspires traders to be long the Euro and short the USD, we are happy to sit on the sidelines until the Euro fails to break through an important upside level and then ride it back down intraday.

Afterall, I’ve been waiting for a retest of the Brexit day low near 1.0900. Yesterday’s high was quite telling and the selling today created a short once again. A move to and below 1.1075 will be very bearish. A retest and close above yesterday’s high will be bullish. Whatever the market chooses to focus on any given day fundamentally, isn’t as important as being able to read the chart and determine the strength and direction of the trend. The USD was weaker at the end of last week, but this doesn’t mean it makes sense to be long Euros or Sterling.

Of course, in the event of a weak NFP number on Friday the USD bears will be back with a vengeance.

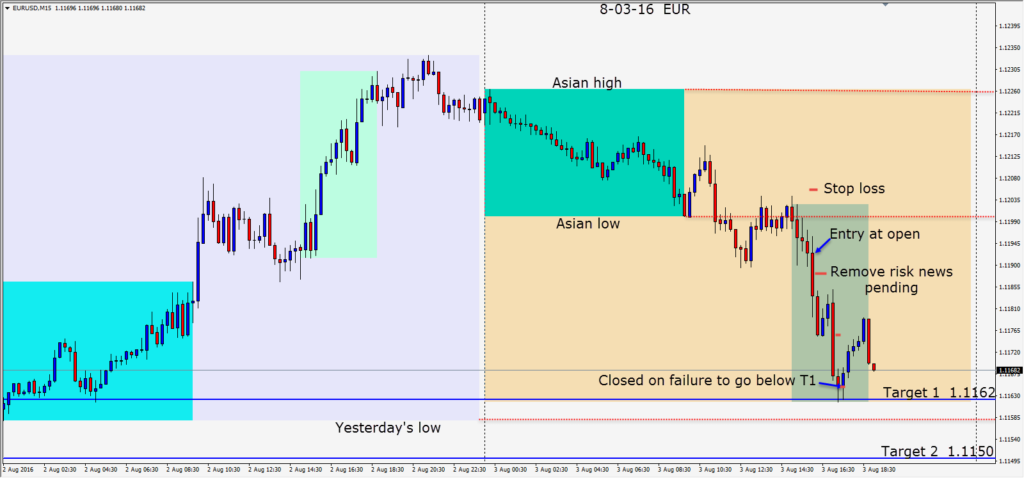

Today, in the early part of the U.S. session, we found a EUR short setup requiring a 13 pip stop loss for a potential 41 pips to our Target 2. When the trade couldn’t go below our Target 1, we closed it for acceptable gains in fairly quick trading.

The GBP has set up nicely several times in the past week but the stop losses are larger than I’m comfortable taking.

Good luck with your trading and keep it simple.