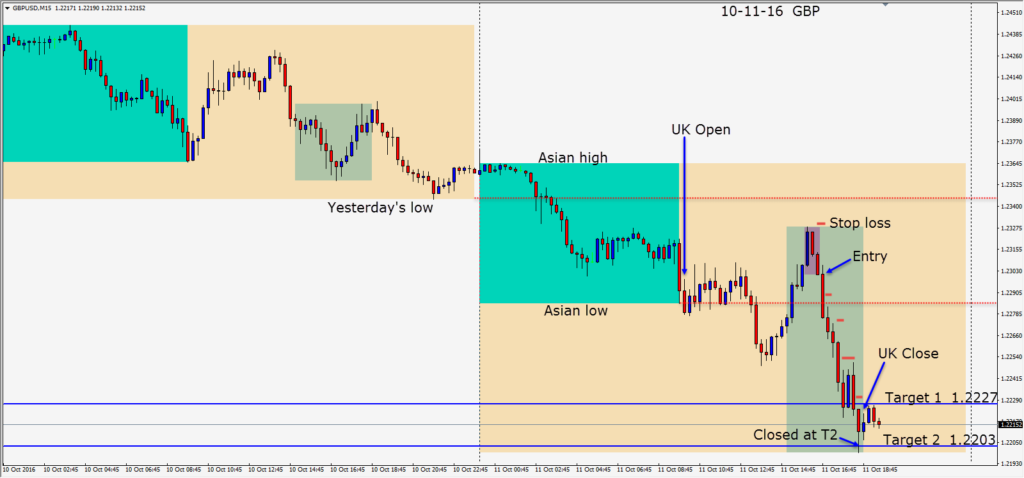

I don’t normally share small trades, because it takes time to mark up a chart and write up the trade. Today’s example is to illustrate the psychology of the GBP short today in line with the tips this week on the use of stop losses and moving them to profit stops.

The GBP is a favourite short of mine. Currently it trades in a range between 1.2080 and 1.2330 – most likely until we get clarity on the High Court ruling.

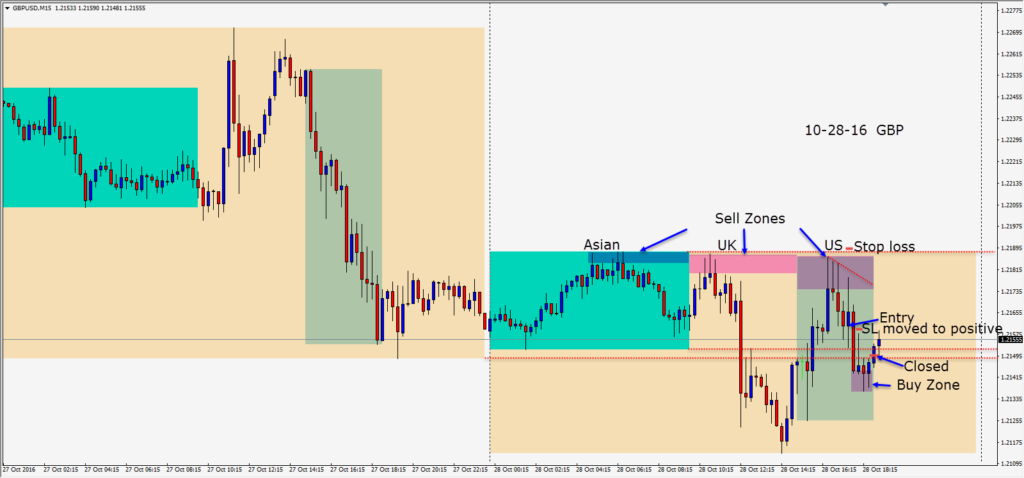

As price shot up early in the U.S. part of the session it ran into sellers – just as it had in the Asian and early part of the UK session.(see chart) The larger charts are bearish, so we have confluence on the downward trending direction. The long upper wicks indicate sellers pushing price lower. An entry short was taken at 1.2161 with a stop loss just above today’s highs – risking 29 pips for a potential 93 pips to our Target Price of 1.2068. If I can get to the earlier U.S. session low – I will be very happy with the trade and of course the more pips the merrier. Statistically it shouldn’t run much past 1.2068 though without some jarring news coming into the market. However…it could get down to 1.2080 to close the week.

The entry candle got off to a bad start and price began rising against me. This can and does happen…to everyone. That is why we have a stop loss entered at the time we execute the trade. If the stop loss gets hit…it closes the trade and could spare us from catastrophic loss should the market go violently or progressively further against us. Put another way…a trader does his thorough analysis, accepts his risk and enters the market on a high probability trade setup. If the market goes against you after you have done your analysis correctly and entered according to your trading plan – then get out. Don’t take it personally…it’s the market not doing what it normally does…so get out. Your stop loss will take you out or you can click out, but you need to follow your trading plan.

The thing I didn’t like was the USD was weakening to the EUR and AUD and then the EUR started to weaken to the GBP briefly, in the EURGBP. cross. As price climbed a bit against me, it began forming a long upper wick as price entered the sell zone. The candle closed with a lower high.(sigh of relief) The following candle dropped as the European session ended – closing below both the Asian low and yesterday’s low. This is usually followed by a retest… much like a retest of a 1.2100 or 1.2200 level.

After this move down, it was time to take the risk out of the trade by moving the stop loss to just into profit or if you prefer to lock in half the move of the large red candle or all of it…that’s fine too. Each way, you’re guaranteed a profitable trade. Price then retraced just above halfway of the large red candle (very common) and then pushed down to close near its low (very bearish). The next candle found some buyers as evidenced by the longish lower wick. This coupled with the U.K close approaching and positions being squared for the weekend makes for a good reason to tighten the profit stop just above this candle’s high. As the close approaches, the trade is closed for a few pips, but executed in accordance to the trading plan.

Not every trade will make you a lot of pips. Following your trading plan, taking an acceptable calculated reward to risk ratio trade setup and being disciplined following your rules is what is important to trading survival.

The question a trader asks himself after a trade is whether he would take the same setup again in the future…all things being equal? Did did he trade in a disciplined manner true to his trading plan? What did he learn from the trade and would he do anything differently in the future?

I hope that helps at least one trader.

Clocks go back in the U.K. and Europe this weekend. North America follows next weekend.

Enjoy your weekend!

****Note to my students – I have removed the Channels Final indicator as it seems to be off since the last MT4 Update. Continue to use the Mod. 1 indicator and draw Target 1 in manually – 15% before Target 2.