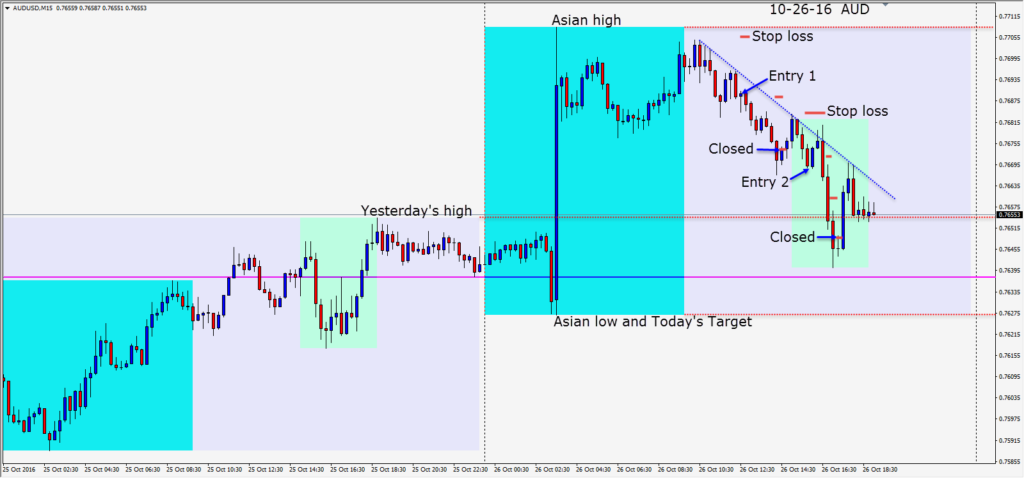

Australia’s CPI q/q yesterday came in at .7% up from the previous .4% and above the estimated .5% the market was expecting. This resulted in the AUDUSD jumping up to the formidable .7700 area where it has a difficult time closing above.

When this type of news reaction move happens with the AUD, I like to look for a short setup as opposed to a continuation. With the Aussie moving back down in the UK session, a short is taken risking 17 pips – above structure for 62 pips to our Target – which is the Daily and Asian session low.

The key here is to lock in profits and let the market take us out if our target price is not attained. A candle with a long lower wick is a warning sign of buyers entering, and we don’t want to give back too much of our profit. We can always enter again…and did today. A second short entry is taken in the U.S. overlap risking 16 pips for a potential 42 pips to the Asian low. This second trade backed up on us 11 pips before moving downward where once again a long lower wick had us tighten our profit stop to lock in 20 additional pips.

Trading Tip: Stop Losses

Always always always use a stop loss. This should be entered at the same time as you enter the market. Although it may sound like common sense, I still come across traders who don’t use them and think they will click out if the market goes against them or even worse…think the market will reverse back and go in the desired direction to profit. The market can and does make sudden huge moves – in a blink and if this is against you… it may cost you your account. I have some strict rules around stop losses and how to move them to profit stops as a trade moves along in the desired direction. This comes from years of experience and also from traders who have been around a lot longer than I have. The bottom line is to always use a stop loss with every trade at the time of execution. Adjust it as needed but always use one.

Good luck with your trading!