CB consumer confidence in the U.S. today followed by both UK Governor Carney and ECB President Draghi speaking .

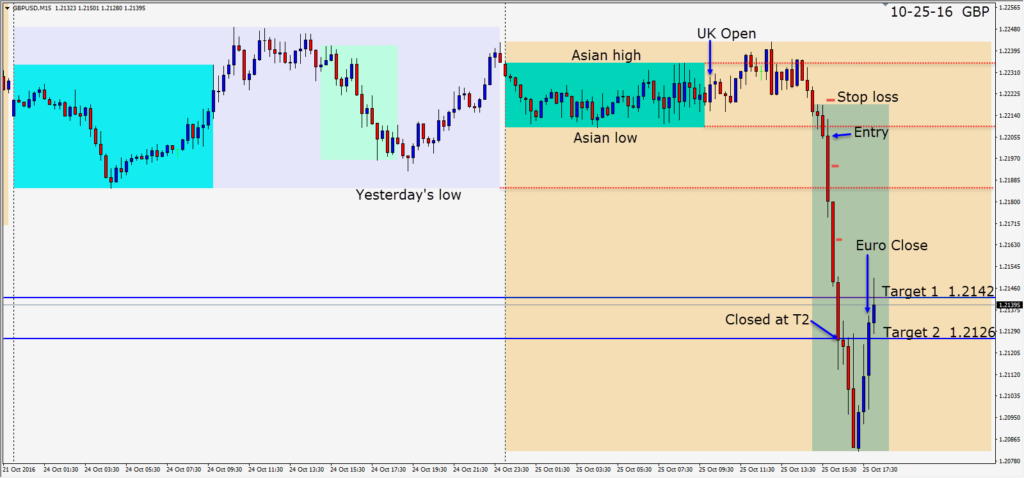

As the U.S. session got underway, the GBP moved through the Asian lows and consistent with the charts, a short is taken risking 15 pips for a potential 78 pips to our Target 2. The idea was to take minimal risk and keep locking in profit… as this pair is particularly volatile and headline sensitive of late with the “hard Brexit” chatter. With Governor Carney speaking during the session, the pair tends to be volatile.

The GBP sold off hard and we exited at our Target 2. Although our next zone level was where the pair bounced…the October 11 low, we were happy to reach our Target 2 and know statistically that this is where the pair most days should run out of gas. With Carney speaking today…it could have dropped another 100+ pips but were happy to leave that trade for someone else.

Trading Tip: If you can find a trading partner and look for setups together as long as you use the same trading style, it can be a rewarding experience. Choose your trading partner as carefully as you would any business partner. When I was trained by a sovereign wealth trader (trades on behalf of countries not corporations) two of his traders worked together. When either saw a trade setup they liked, they immediately had the other one check it. If they both liked the trade, they both entered and if one didn’t like the setup…neither entered. I watched these two traders who reminded me of a married couple, each make $200,000 in 20 minutes on a single trade on a slow day. They both were former Chicago Mercantile Exchange floor traders who had done very well for themselves and were continuing to do very well indeed.

Good luck with your trading!