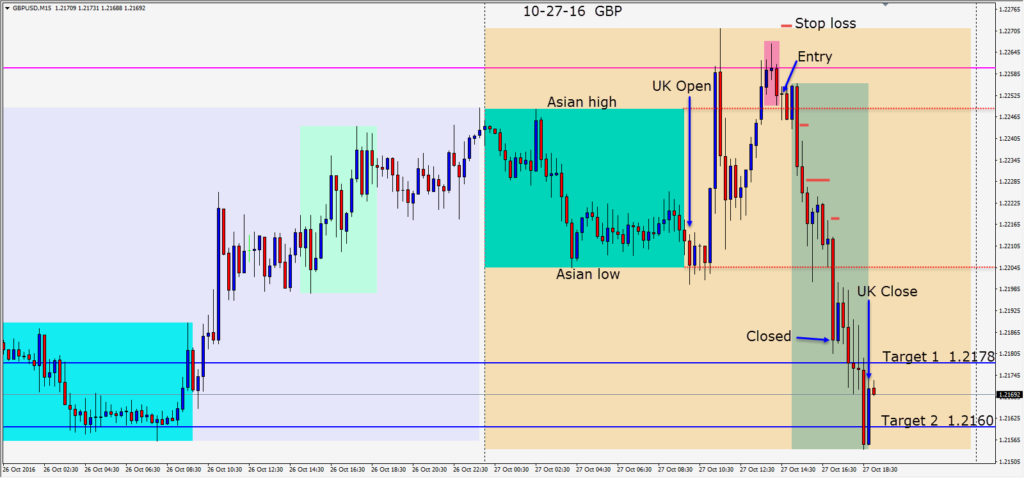

An hour before the U.S. session began the GBP made a second lower high in the session, accompanied by a 3 candle reversal. A short is taken risking 20 pips for a potential 92 pips to our Target 2. Price started to plummet just in advance of the U.S. Core Durable Good Orders and Unemployment Claims release…so who knew?

Price continued down and briefly bounced above the Asian session low before quickly dropping right through the 1.2200 figure. Not wanting to give back any pips on the probable retest of the 1.2200 level – we chose to close the trade.

Trading Tip:

Following up on yesterday’s tip of ALWAYS using a stop loss at the time of trade execution…is moving your stop loss to a profit stop. When the market moves in your direction, get the risk out of the trade as soon as is reasonable… especially when economic news is pending as the market tends to get volatile. If you’re up 15 pips, it’s a good idea to get the risk out of the trade by putting your stop loss to plus one or two. This strategy has two beneficial effects. The first being the trader can be stress-free having eliminated the possibility of losing any money. The second being that the worst case scenario is still a positive trade and your account grew. This is very different psychologically from having a winning trade move against you and hit your stop loss which is never fun and happens to all traders. Remember a plus one or two pip trade is a positive trade and as the adage goes…no one goes broke taking a profit.

As a trade moves further in your direction, lock in more profit by moving your profit stop closer to current price – also known as trailing the stop. Let the market take you out, hit your targets or click out for your own reasons as was done today. The most important thing is to not let a nice profit turn into a loss. Over time you will get better and better with your profit stop placements. Personally, I like to move it above structure , a strategic level or halfway up a large candle.

Good luck with your trading!