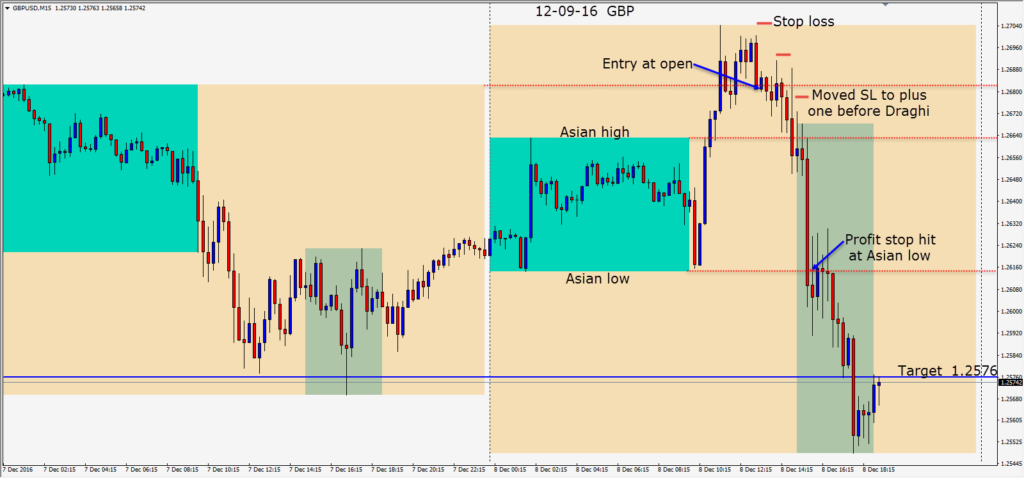

Trading up until Thursday was fairly quiet but in advance of the ECB conference on Thursday, a GBP trade set up as price began to roll over. Risking 24 pips for a potential 104 to our Target, we went short. Less concerned about the pending U.S. Unemployment Claims and more concerned about the markets reaction to Mario Draghi’s speech, we felt a little insulated by trading the GBP and not the Euro. As the U.S. session approached, we moved our stop loss to plus one, in case the market’s volatility moved the pair against us.

Price dropped and our pattern completed. With price bouncing higher after the initial plunge lower, our profit stop was hit.

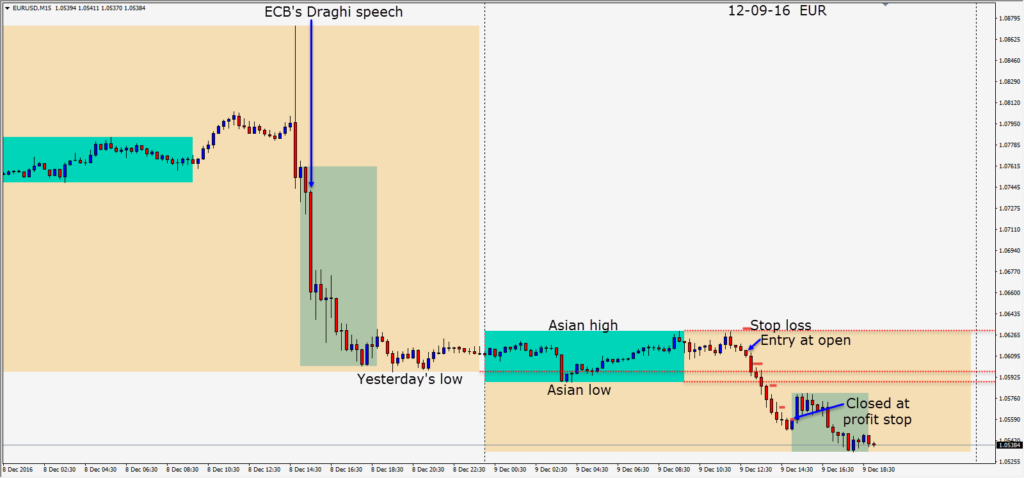

On Friday, we were comfortable going back to shorting the EUR as it continues to trend lower. With the exaggerated move on Thursday, we weren’t expecting to get too much of a move Friday before the weekend. When price could not go above its Asian high, we waited for a candles to move lower and went short. As price dropped, we remained cognizant of yesterday’s low and Friday’s Asian low. Protecting profit as it dropped, we comfortably rode it lower and as the U.S. session got underway we were taken out for a nice gain.

Next week the FOMC is expected to increase the interest rate for a 2016 “one and done” which as of Friday was 100% priced into the market. If the hike doesn’t occur – we will have an interesting reaction as traders will have been caught offside. The USD closed the week strong.

Good luck with your trading and enjoy your weekend!