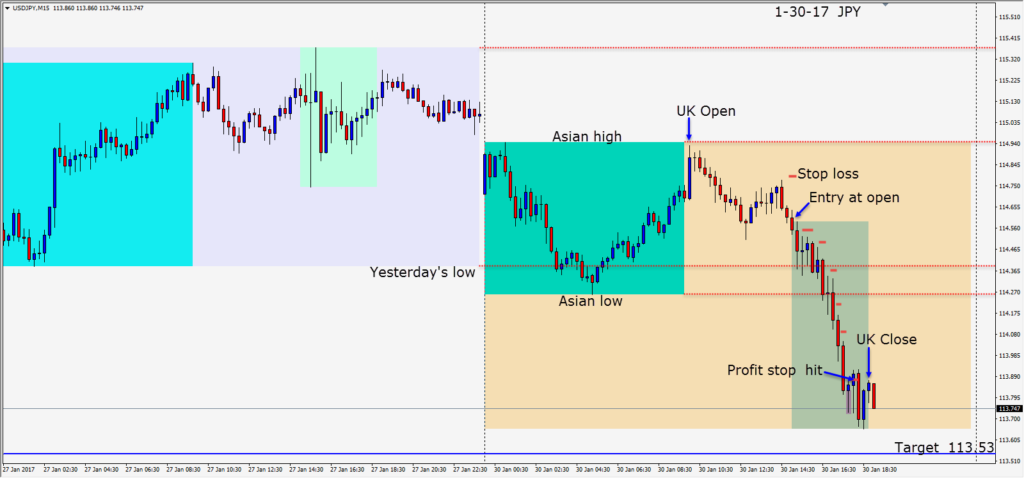

I don’t usually look for trades on Mondays, but due to it being a shortened week as I avoid NFP Fridays, I was happy to catch a nice setup on the USDJPY. The USDX started the week in a very volatile manner and with a very light economic news day the market was more reactionary to political rhetoric than usual. I suspect a number of analysts were contemplating how protectionist policy and imposing higher tariffs on imported goods to the U.S. would weaken the USD. That caught some attention!

The USD fell shortly after the London open, then made a small up-wave before rolling over in advance of the U.S. open. With a stop loss placed 18 pips above our entry for a potential 108 pips to our Target, we went short at the U.S. open. The U.S. traders pushed the pair lower and we protected our profit as price descended allowing for some room for testing and retesting at the Asian low and previous day’s low. When we saw a long lower wick appear, we tightened our profit stop and the next candle closed our trade for a very nice outcome.

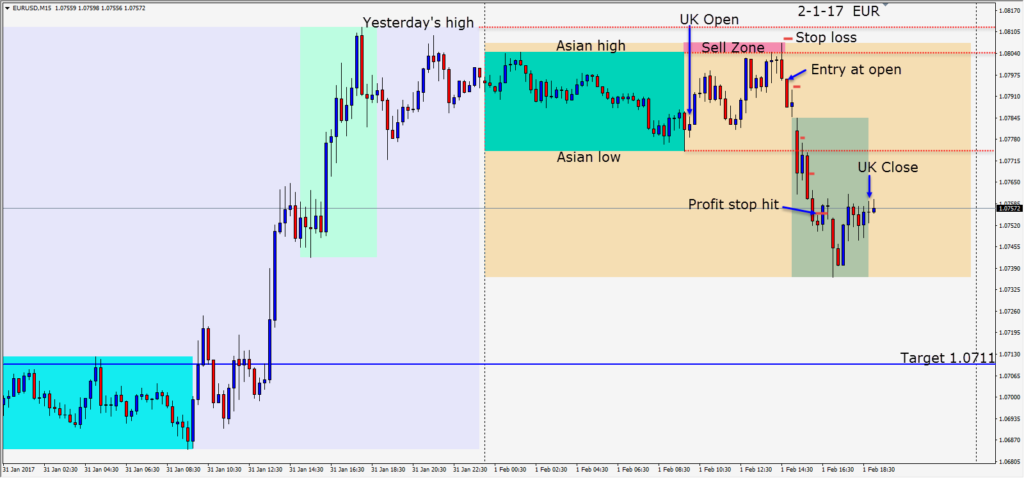

On Wednesday, a nice trade setup occurred in the EURUSD. Price had been unable to close above its Asian session high. Thirty minutes before the U.S. open, price once again tried to move higher and sellers pushed it back down to close near its low. Knowing that there were large sellers lurking at the 1.0800 area – a short was taken risking 12 pips for a potential 85 pips to our Target. We moved the stop loss to plus 1 in advance of the ADP Non Farm Employment release and continued tightening our profit stop in advance of the ISM Manufacturing PMI release. A brief move up in price took us out before the PMI release.

January was a very bullish month for the EUR… which was intriguing for me. There are pending elections in the Netherlands, France, Germany and Italy this year. The markets are more focused on the new U.S. Administration at the moment than on political uncertainty in Europe. Price has been rejected at the 1.0800 area and tomorrow will be interesting as the market reacts to the NFP number.

Strong language from President Trump regarding currency manipulation directed at Germany, Japan and China is making things very interesting. It will also be interesting to see if the USD will have another continued move lower in February.

Read the current trends and pay attention to the critical areas where trends can end,. Trading with the trend is a lot easier to make money. Critical areas tend to be tested and retested. Price rarely moves through them without a retest, so lock in profits as the market moves in your favour. Trade the pairs that are easier to interpret. If the EUR and GBP are moving opposite directions, look for a setup in the EURGBP. Trade what you see not what you think may make fundamental sense. The USD direction remains as clear as mud at the moment with a somewhat hawkish Fed and a president wanting a lower dollar.

Keeping a close eye on USDX, the U.S. 10 year yield and global equity markets will help validate your trading decision.

Good luck with your trading!

Back next week.