The week had been slow as traders awaited the outcome of the F.O.M.C. statement as to whether March looked like a good time to raise interest rates or maybe…not. Here we go again… month by month assessing whether the economic data is strong enough for the Fed to raise rates at their next meeting or not.

The outcome yesterday was a weaker USD as it doesn’t appear like the March meeting will bring about an interest rate hike. U.S. equity markets are up 15% since the election…inspired by tax reform, infrastructure spending and banking deregulation prospects.

A number of trades set up today requiring very little risk to trade against the USD.

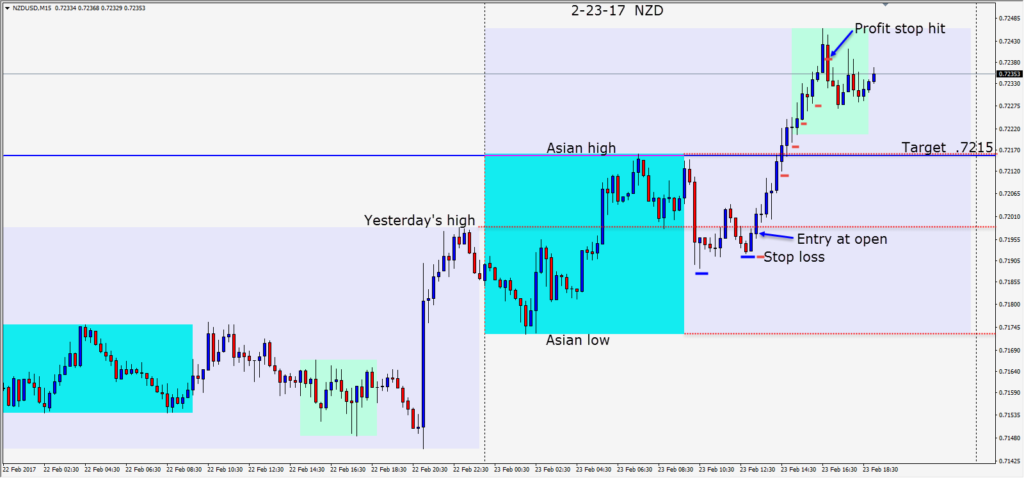

As the ranges have been somewhat subdued this week as traders awaited the outcome of the Fed, it wasn’t surprising to see the market get active with the news behind us. I like the resilience of both the AUD and NZD (commodity currencies) and found a an entry long into the Kiwi with a 6 pip stop loss for a potential 18 pips to our Target. The setup was a classic “W” pattern and fortunately the pair moved straight up…keeping us in the trade until the pullback.

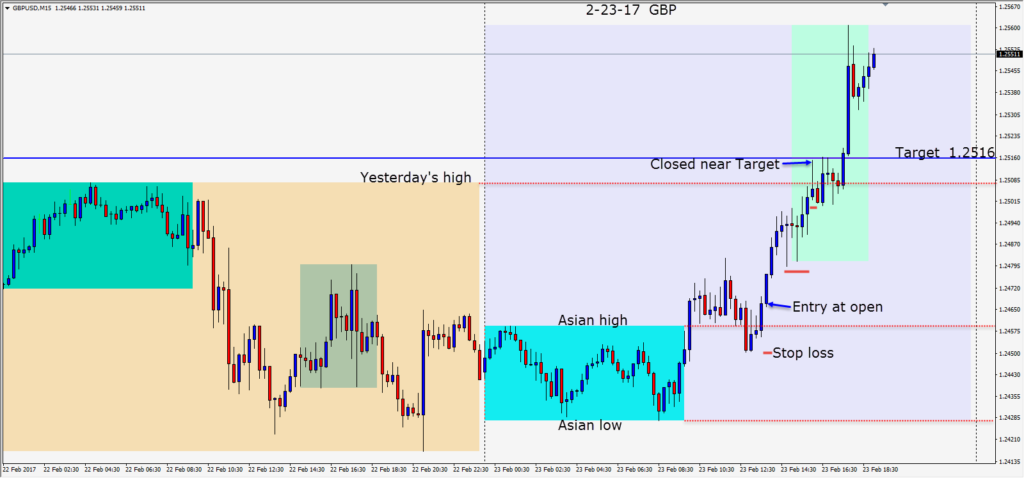

The second trade was the GBP which has been beaten down due to Brexit concerns. It’s important to note that the U.K. economy is doing quite well and the market will be focusing on political risk in Europe with the pending elections. This to me suggests shorting the EURGBP when the charts look enticing. Today we had that opportunity, but I chose a GBP long (my preferred direction at the moment) and as it turns out got out too early. The reward to risk ratio was a couple of pips under a 3:1 and as price got within a tick of the Target, we closed the trade… being very cautious. Oh well…it then moved substantially higher.

I am beginning to wonder if the triggering of Article 50 next month will turn into a non-event for the market. The European elections outcome implications may be much more concerning to the market over the next few months. If the EURGBP continues downward and takes out its December 2016 low and continues lower, the .8000 level becomes a probable target.

The USD although on its back foot at the moment will likely strengthen as the market gets a better understanding of President Trump’s fiscal policies.

Good luck with your trading!