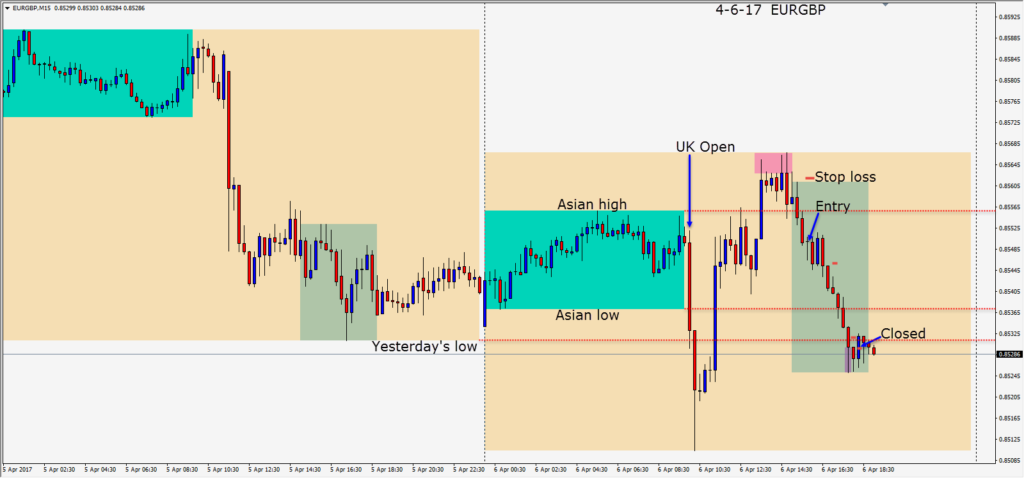

Mario Draghi said little to encourage any Euro buying on Thursday. Waiting until the U.S. session began, we conservatively waited for a short setup. With a small stop loss above the U.S. session high, we entered short hoping to get down near the .8500 level. Price moved down to test its Asian session low before finding buyers under yesterday’s low. When a long lower wick appears, experience tells me to tighten up my profit stop as buyers are entering…and to watch the next candle closely. As the U.K. session was ending soon, we exited the trade as price began to move up.

Tip: On Tuesday during the U.S. session, I entered short the USDJPY after a second lower high and a very bearish candle. The trade moved immediately in my favour. I then got busy with something else and took my eye off the trade. I glanced back a few minutes later and the pair was moving nicely down. Instead of protecting myself and moving my stop loss to a profitable plus one, I focused my attention elsewhere, thinking that I would check back in a bit to check on the trade. When I did, my trade was closed and the stop loss had been hit on a reversal.

There are risks associated with trading and we accept those risks whenever we enter a trade. When a trade becomes profitable, if you can’t keep your eyes on it, remove the risk from your trade by moving your stop loss to a positive net position. Even if this is just plus one pip, it makes more sense than being stopped out and puts you in a “stress free” position while the trade is on. I really kicked myself for being distracted and not having moved my stop loss down in this case. The stop loss was only for 13 pips, but if I can’t watch my trade to interpret what price is telling me, then I need to remove the risk from it… or not trade. Be very careful of distractions when you’re trading as they can be be expensive lessons.

Enjoy your weekend and good luck with your trading!