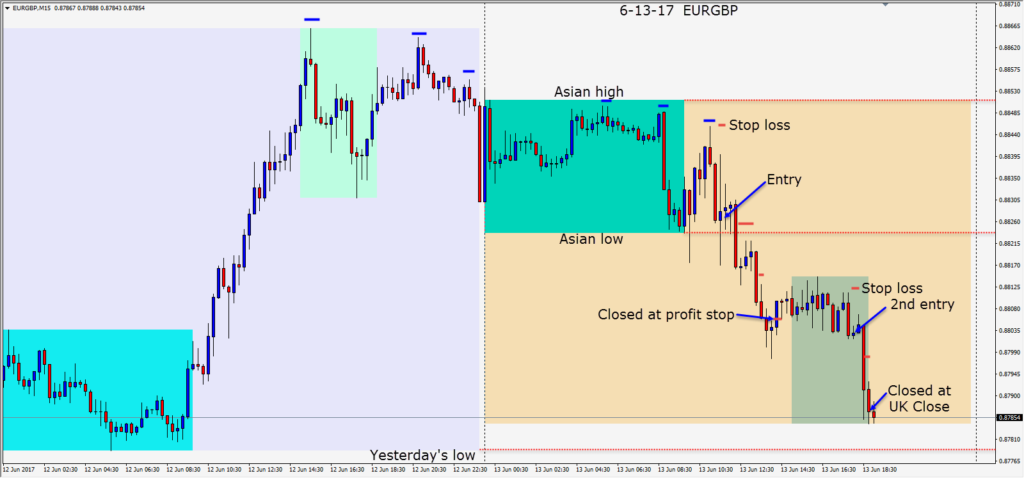

After a series of lower highs, the EURGBP set up for a short as did the EURJPY at the same time…confirming euro weakness once again above the .8850 level. Risking 20 pips for a potential 72 to our daily target which was .8785 – a short entry was taken. Price was slow to move down but eventually broke to the downside. Price made a nice wave to the downside before long lower wicks formed – meaning that buyers were entering and our profit stop was tightened and hit.

Price went sideways during the first 3 hours of the U.S. session before breaking once again to the downside where a second short entry was taken. At the close of the U.K. session price was having difficulty breaking the .8785 area once again, nor had it tested yesterday’s low and we closed the trade.

The market has priced in a rate hike tomorrow from the Fed. Traders will be listening closely for any suggestion that a September rate hike (currently a 28% probability) is on the table. A third rate hike this year is currently a 48%-55% probability. Before the FOMC statement tomorrow there are CPI and Core Retail economic releases to add some volatility to the majors.

Good luck with your trading!