I found it to be rather curious that with traders predicting a rate hike by the U.S. Federal Reserve yesterday with a near 98% certainty, the USD was very weak going into the FOMC announcement. The sentiment reversed after the news and the USD is stronger since… versus the majors.

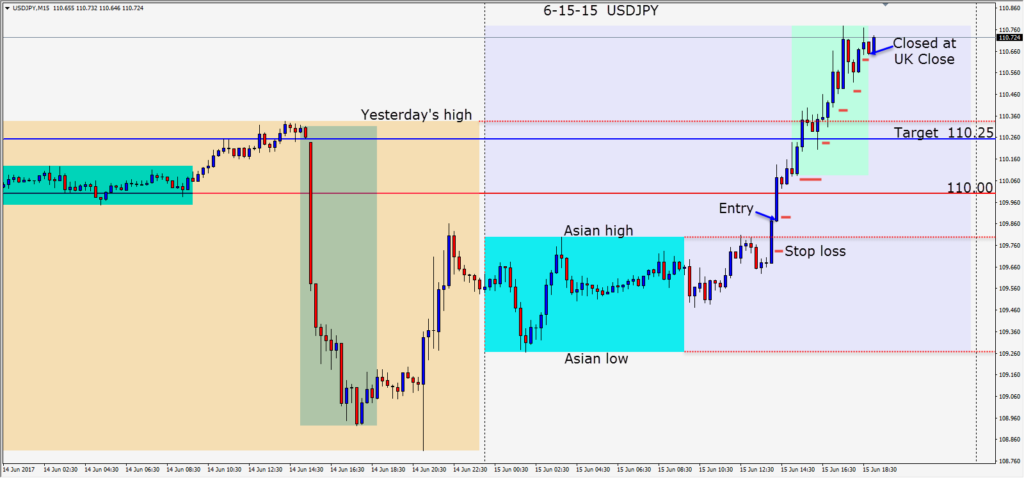

We found an opportunity to go long the USDJPY in advance of the U.S. session and were rewarded. The key to the trade was in moving up the profit stop frequently to allow our profits to be locked in without being rattled out of the trade.

Once price moved up and closed bullishly above its Asian session high, we entered with a tight stop loss allowing for price to retest the level. The next area to get through was the 110.00 big figure and then our target of 110.25 and yesterday’s high. This pair tends to move well during the U.S. session and once again traders pushed it higher toward the London close… where we exited.

Good luck with your trading!