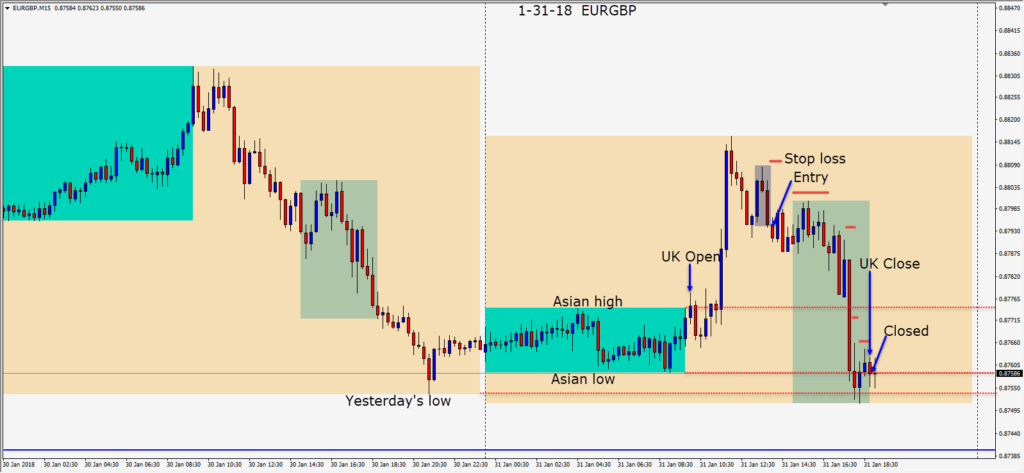

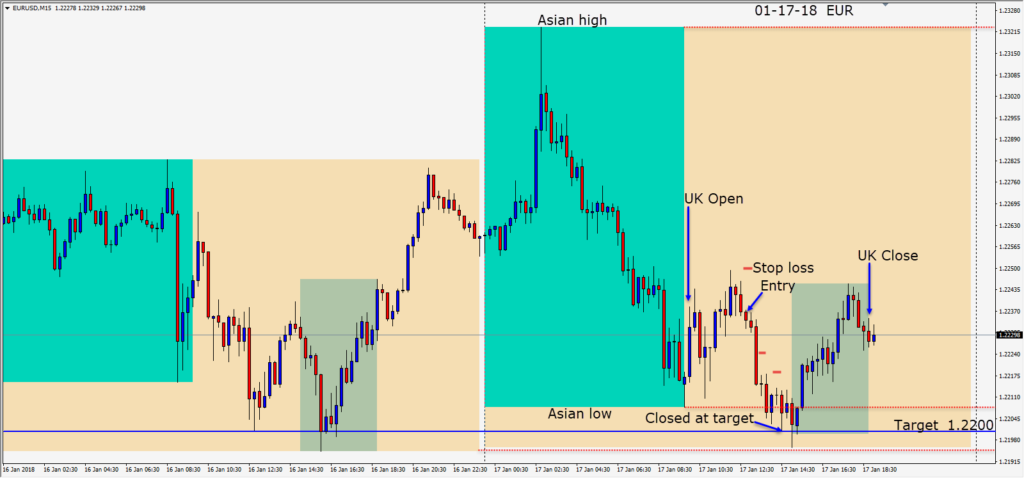

The majors didn’t offer any high probability trade setups in my opinion today…however the EURGBP set up for a short entry an hour before the U.S. Open. The EURGBP is worthwhile watching during the Brexit period as it can be fairly easy to trade and active.

I particularly like it when the EURUSD and GBPUSD are diverging which was not the case today. As evidenced on its daily chart the pair is trending downward. The .8700 figure may be difficult for it to get through this week as buyers have been appearing at this level recently.

Our trade was taken with a 15 pip stop loss for a potential 54 pips to our daily target .8740. Price eventually moved down during the U.S. overlap and we closed the trade at the London close where price was sitting at its Asian low. The British economy is improving and doing quite well overall. The European economy is doing well too but inflation remains below 2% and Mario Draghi still has time to decide to either taper QE or not. An interest rate hike is not likely while inflation remains below 2%.

President Trump’s speech last night did little for the USD and the FOMC today is not expected to deliver any surprises at Janet Yellen’s final meeting as chairperson.

If Thursday brings any setups of interest, I will be back tomorrow, otherwise next week as I prefer not to trade on NFP Fridays.

Good luck with your trading!