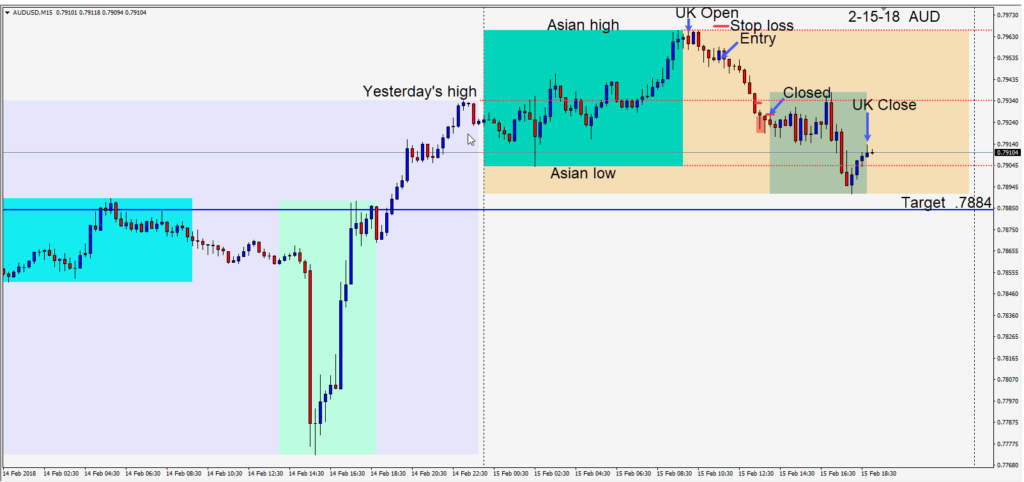

Australian employment rose 16,000 in January and the AUDUSD moved up during the Asian session. When London opened, the Asian session high was not broken and price began to fall. As price continued to move down we went short risking 16 pips for a potential 68 pips to our daily target.

Price slowly moved lower before slowing down just below yesterday’s high. As long lower wick candles emerged, we tightened our profit stop to just above the previous candle high and we were taken out of the trade.

Although the market is expecting 3 interest rate hikes this year in the U.S. the recent CPI upside surprise has brought into question whether the FED will have to raise interest rates at a faster pace. Normally one would expect this to be USD positive but the market is very erratic currently and the USD is having a hard time sustaining a bid tone. The JPY on the other hand is up 6% versus the USD and is the best performing G 10 currency. The BOJ despite this… says that it is not enough to require intervention.

Be cautious when markets are not making sense and correlations are fading…for the moment.

Good luck with your trading!