President Trump introduced tariffs for China and now China will impose some tariffs on U.S. goods imported into China. The ECB seems to have dodged the tariffs from the President for the time being, but this still has the global stock markets rattled and dropping each day.

The USD has been dropping since the interest rate hike on Wednesday with the less than hawkish tone some market participants were expecting from the new Fed Chair Powell. This coupled with $60B in trade tariffs for Chinese imports into the U.S. and the market is nervous and in a “risk off” sentiment.

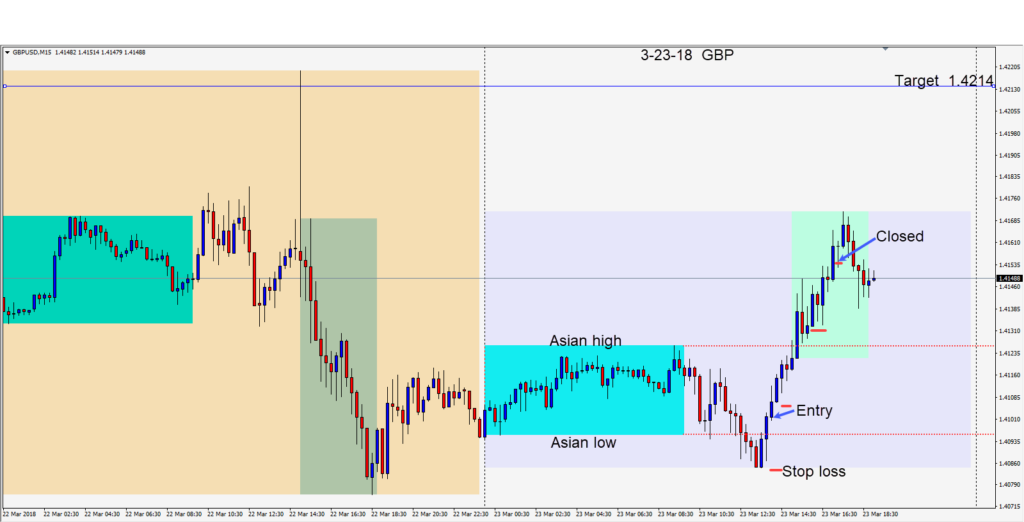

The GBP has benefitted this week from progress in Brexit negotiations and now talk of a pending interest rate increase in Britain. Today we found a long setup for the GBPUSD requiring an 18 pips stop loss for a potential 111 pips to our daily target.

Price rose in advance of the U.S. session open and continued upward but began to run into sellers and our trade was closed at our profit stop well short of our daily target.

Enjoy your weekend and good luck with your trading!