Trading is active but even an interest rate hike was not able to prevent the USD from selling off heavily yesterday. Although new Fed Chair Powell raised the interest rate by 25 basis points and is expected to do so twice more this year, his comments did not lead traders to believe that a fourth rate hike will happen in 2018. Having already priced in 3 rate hikes for 2018, the USD sold off and traders’ concerns quickly changed from rate hikes and inflation expectations to tariffs against China and a global trade war.

Today the USD gained a bit of strength, but the market is still very risk adverse as was evidenced by the rise in gold and continued stock market sell off.

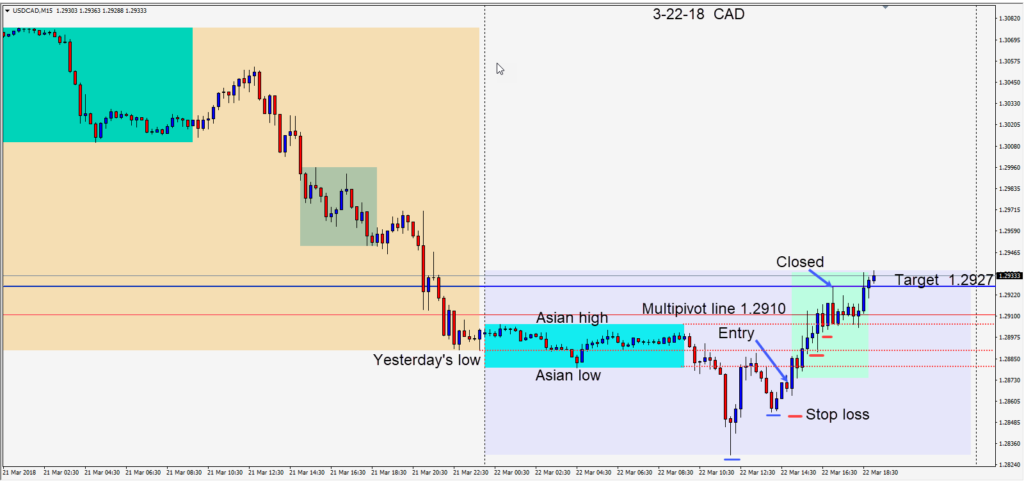

With WTI lower today combined with a moderately stronger USD, we took advantage of a long setup on the USDCAD… risking 18 pips for a potential 55 pips to our daily target. Fortunately the trade progressed quickly to our target as there were multiple levels in which the pair could have rested and retested along its way higher.

There are a number of economic releases for Canada on Friday along with the Core Durable Goods for the U.S. Will the USDCAD be able to close the week above 1.3000 or will sellers enter near that level? The Bank of Canada has a dovish tone at the moment and is being very cautious as NAFTA is renegotiated.

Good luck with your trading!