Looking at the daily chart of the GBPUSD, we can see how the pair continues to make a series of lower highs. It may not be long before price comes down to test last September’s high before moving lower. There is plenty of downside for the GBP, but on any given day a headline regarding Brexit could potentially move it up in the short term. Currently my preference is to look for short setups.

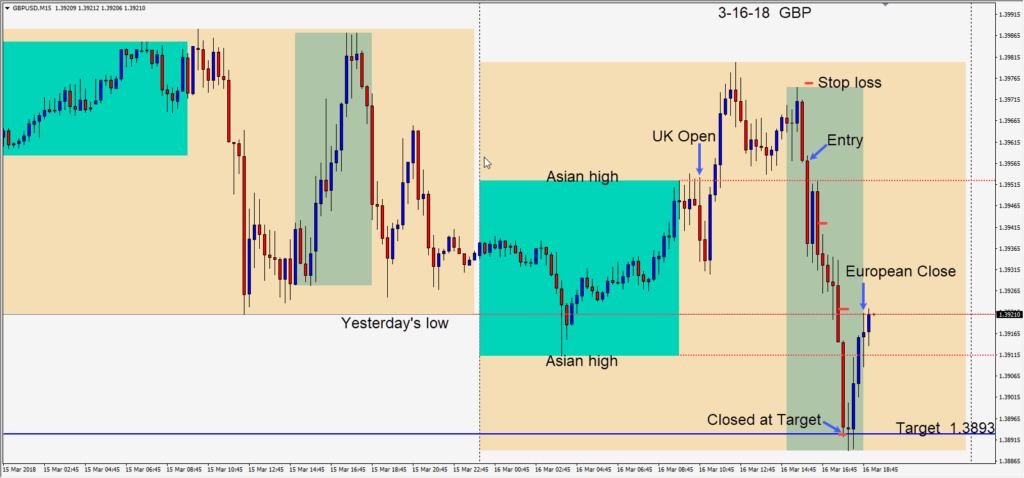

As price made a lower high as the U.S. session got underway, a short was taken today risking 18 pips for a potential 63 pips to our daily target at 1.3893. Price moved down, retested its Asian high…as it tends to do… then descended to our target where we exited the trade.

Trading has been very good this week but I took Wednesday and Thursday off. With all the turmoil regarding free trade and tariffs, the markets are very active. As President Trump hires and fires within the White House, we also see the markets reacting. As I mentioned earlier this week, there is a lot of fundamental reasons to be bullish the USD, but the markets don’t always comply with fundamental analysis. Continue to trade what you see and keep your stops tight.

The Trump administration whether you agree with it or not, certainly keeps things very interesting and somewhat entertaining.

The Daylight Savings Time shift for North America has another week to go before Europe and the U.K. adjust their clocks forward. I won’t be adjusting my charts in the meantime.

Good luck with your trading and enjoy your weekend!