I’m behind on my postings due to some site update issues which sent my emails from Friday afternoon until Tuesday morning into lost cyber space. If you tried to reach me over this period, please email me again as the issue has been corrected.

The markets have been very volatile as “trade war” talk and tweets have created uncertainty for the capital markets. Who will be affected by steel and aluminum tariffs imposed by the U.S is still not clear… nor are the retaliatory measures that affected countries might impose against the U.S. We do know that Mr. Cohn has parted company with the president over the issue and the markets reacted swiftly.

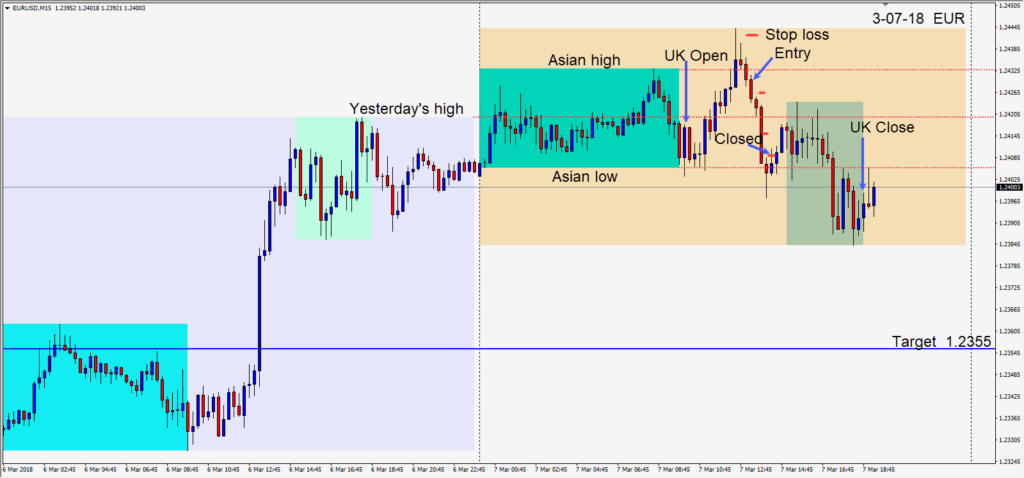

On Wednesday as the EURUSD failed to close above its Asian high, a short setup was found with a very attractive return if price had made it down to our daily target. When price bounced back above its Asian low, our profit stop was triggered and the trade yielded a modest gain.

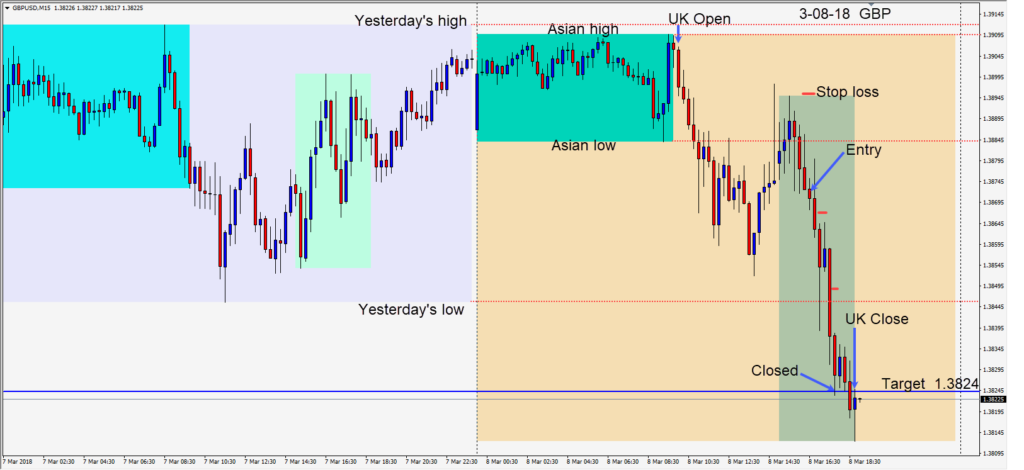

Today, we chose to trade the GBPUSD early in the U.S. session and avoid the potential volatility while ECB President Mario Draghi was speaking. The USD was strong today after a volatile week and we risked 23 pips for a potential 47 pips to our daily target at 1.3824. Price moved down quickly and we closed the trade as our target.

The markets remain in a heightened sensitivity mode so it is prudent to keep your stop losses tight and cherry pick your entry setups…while protecting your profits.

I will back next week and pass on trading tomorrow with the NFP numbers due.

Good luck with your trading!