I’m back from holidays and could not find any trade setups that I liked until Thursday. The market appears to have cooled off with most of the pairs trading tighter ranges than when I left at the end of March.

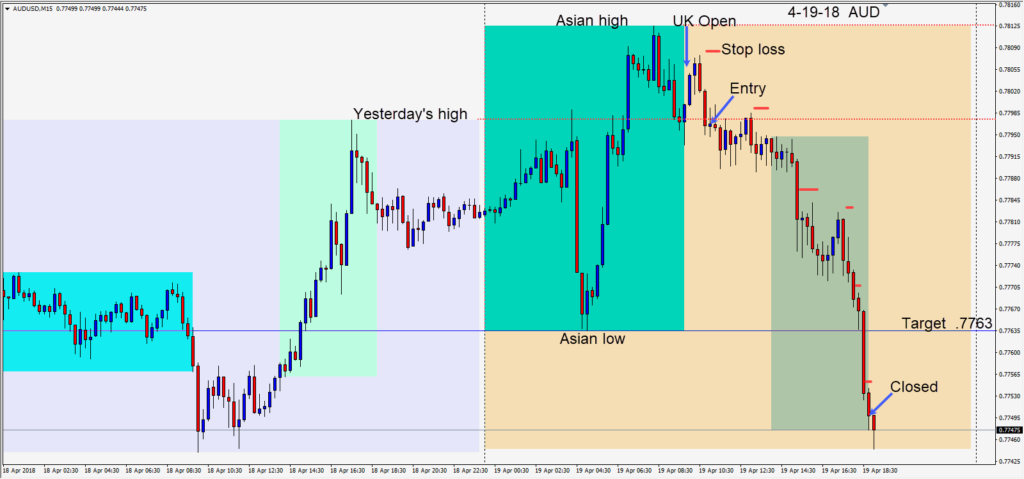

On Thursday a trading pattern set up on the AUDUSD. This has been a favourite pattern for trading the Aussie, but it’s not as common as a few years back. The AUDUSD which has been very subdued in its trading lately moved up to do its daily range during the Asian session before making a lower high as the UK session got underway.

As price rolled over, a short was taken risking 12 pips for a potential 38 pips to our daily target at .7763 . Price went sideways going into the U.S. session open and then began to drop. We were hoping to get to its Asian low, but price dropped abruptly as it neared our target. As the UK session ended, we closed the trade.

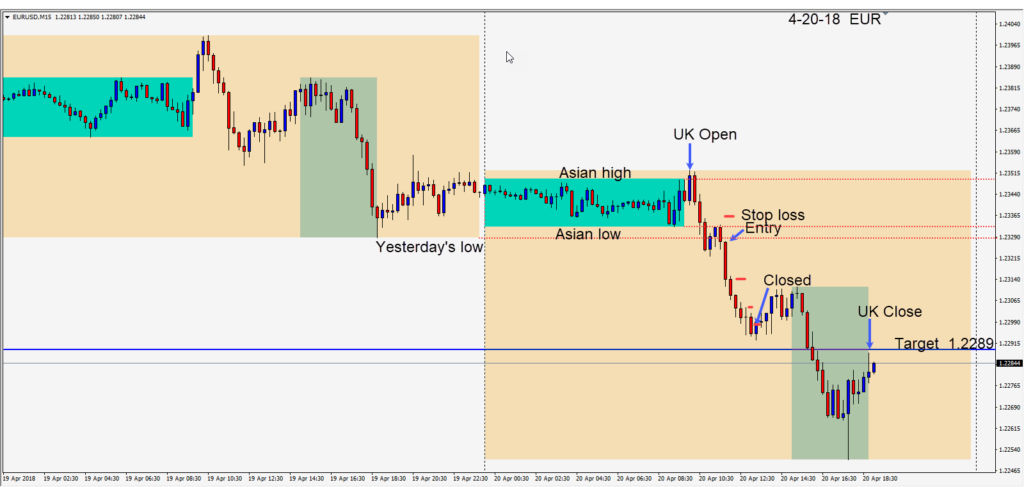

On Friday, the USD continued to strengthen buoyed by U.S. 10 year yields rising over 2.90% coupled with a widening spread difference between German and U.S. bond yields.

As the EUR began to move lower after making a lower high, we were able to take advantage… risking 9 pips for a potential 38 pips to our daily target at 1.2289. Price moved below yesterday’s low but began to retrace before the U.S. open and our profit stop closed the trade.

The pair made a 3 drives pattern by the time the U.K. session ended but we only participated in the second drive lower.

Enjoy your weekend and good luck with your trading!