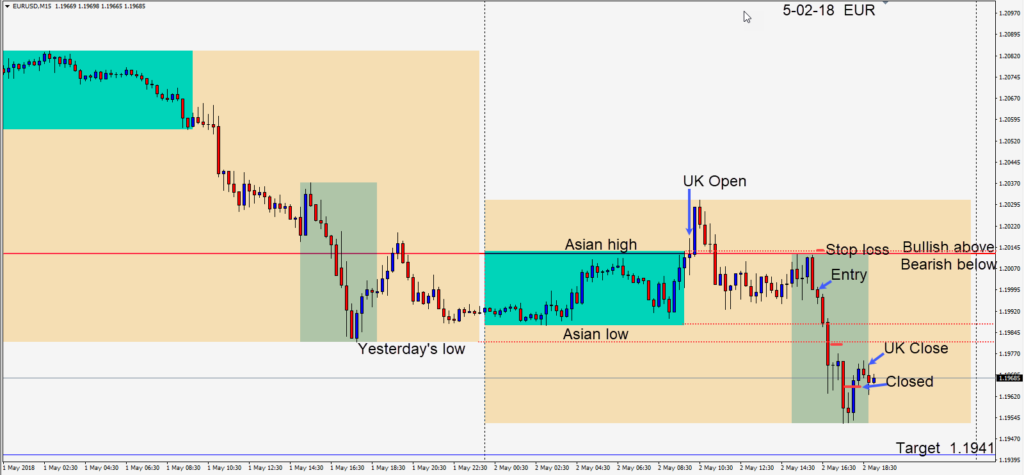

On Wednesday, the EURUSD moved up to begin the U.K. session but could not stay above a very important technical level. It then moved back down and traded sideways going into the U.S. open.

A bearish engulfing candle set up our short entry…risking 15 pips for a potential 57 pips to our daily target at 1.1941. Price moved down to its Asian low then continued downward through the previous day’s low. We moved our profit stop down to protect this level, as long lower wicks were forming. Price then made a new low for the day before double-bottoming and bouncing us out of the trade – well in advance of the pending FOMC meeting.

On Thursday, after the economic news releases the USDCAD moved down to test its Asian low, and bounced with a bullish engulfing candle. A long was taken risking 17 pips for a potential 34 pips to our daily target at 1.2892. Price moved up quickly closing above our target. We protected this level by moving our profit stop to it. When price dipped down on the next candle our trade was closed.

As expected the FED did not raise rates yesterday. The USD was weaker today as trade concerns between the U.S. and China heat up.

Last week trading was very good with the exception of Friday. We will take tomorrow off as we do on Non Farm Employment release days each month.

Good luck with your trading and enjoy your weekend.