Trading has been interesting this week. With President Trump’s announcement regarding Iran, the USD has temporarily lost its momentum upward and crude oil (WTI) is above $70 for the time being. Israel is aggressively defending itself against attacks, which creates uncertainty in the Middle East. This can lead to higher oil prices and a flight to safety. We haven’t seen this yet in the equity markets, but the US 10 yr yield remains below 3% and gold is catching a bid…at least for now.

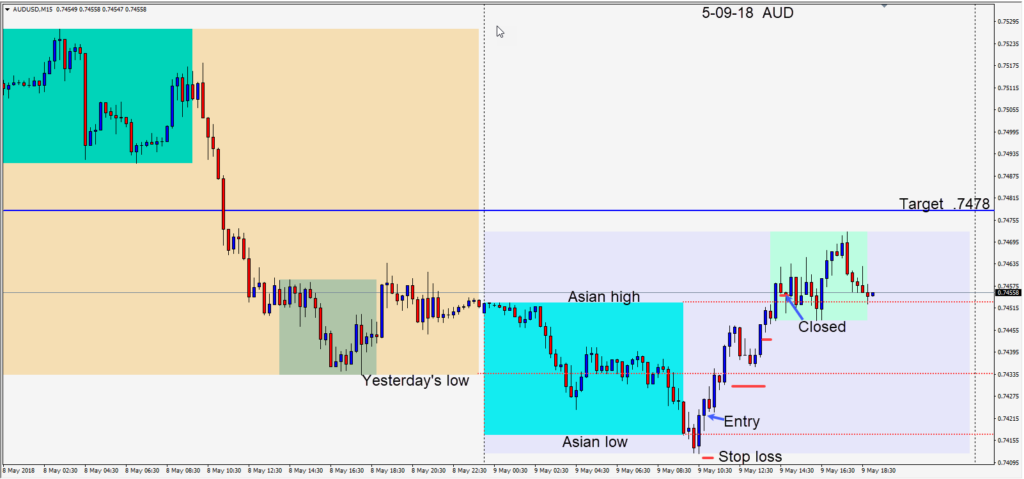

On Wednesday the markets reaction to the President’s speech created some countertrend moves in the majors. We chose the AUDUSD as the stop loss was 12 pips for a potential 56 pips to our daily target at .7478. As this was a countertrend trade, we moved our stop loss upward quickly to take the risk out of the trade and we exited the trade early in the U.S. session at the first sign of a pullback.

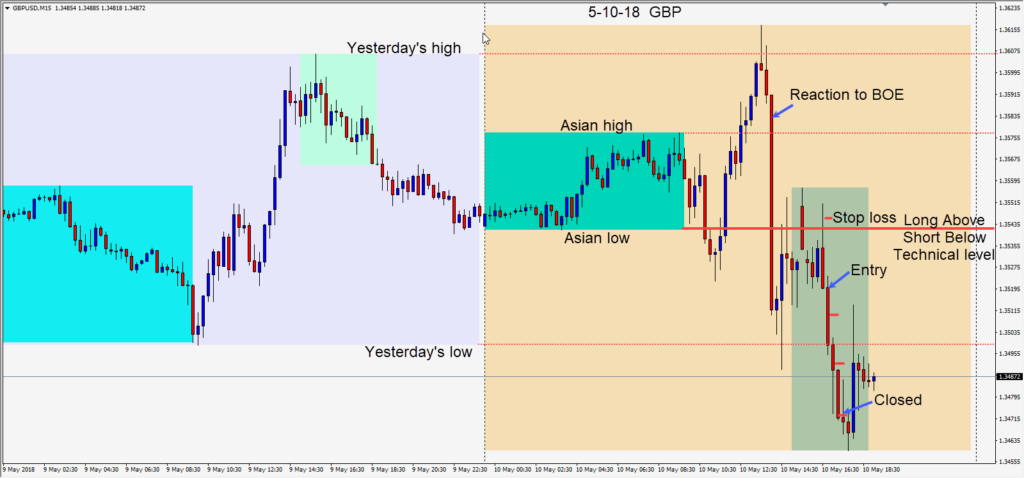

On Thursday, the Bank of England which has been susceptible to credibility issues of late, released its inflation report and monetary policy summary. If you have been watching this pair, it has been sitting near a critical level as the market awaited this news. Essentially the market wants to hear from the U.K. that there will be a pending interest rate hike soon… and it’s not hearing it. This caused a sell off reaction, a pullback, followed by continued selling as the critical level gave way with no closes above it. Despite USD weakness today the GBPUSD fell dramatically.

With both the GBPUSD and the EURUSD, I’m looking for short setups as there is plenty of room for both pairs to fall further.

Keep an eye on geopolitics, USD strength/weakness, along with the overall market tolerance for risk.

Good luck with your trading!