The markets are gyrating about as uncertainty regarding Italy’s ability to form a euro-friendly government remain in question. Spain too may have a change of government pending. Uncertainty will not help the Euro.

The U.S. is imposing tariffs at midnight which will have very far reaching implications and likely retaliatory measures from its trading partners.

The good news is it appears that the summit with President Trump and North Korea’s Kim Jong-un is on again.

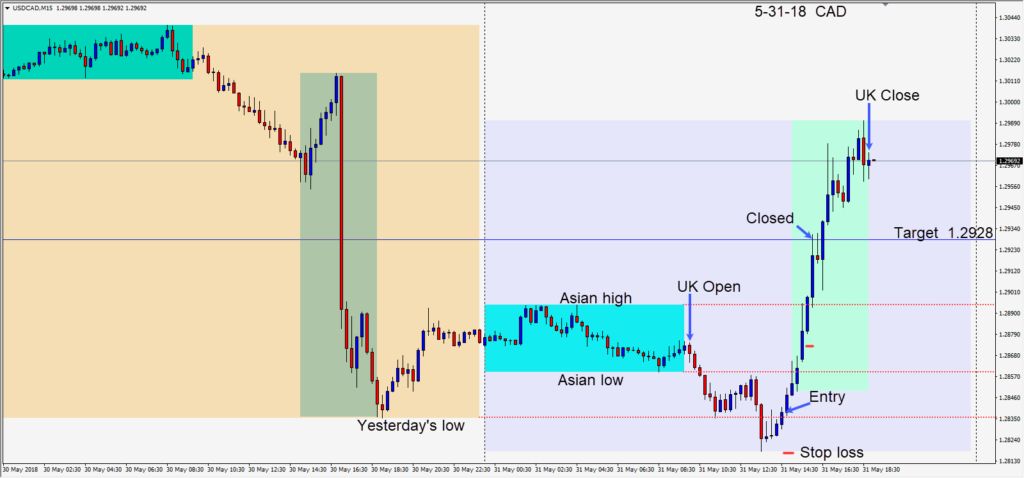

Today as oil prices weakened ahead of the crude inventories the USDCAD moved up. Risking 20 pips for a potential 90 pips to our daily target at 1.2928 we entered long. Price moved up quickly to our target where our trade was closed…then price continued higher without us.

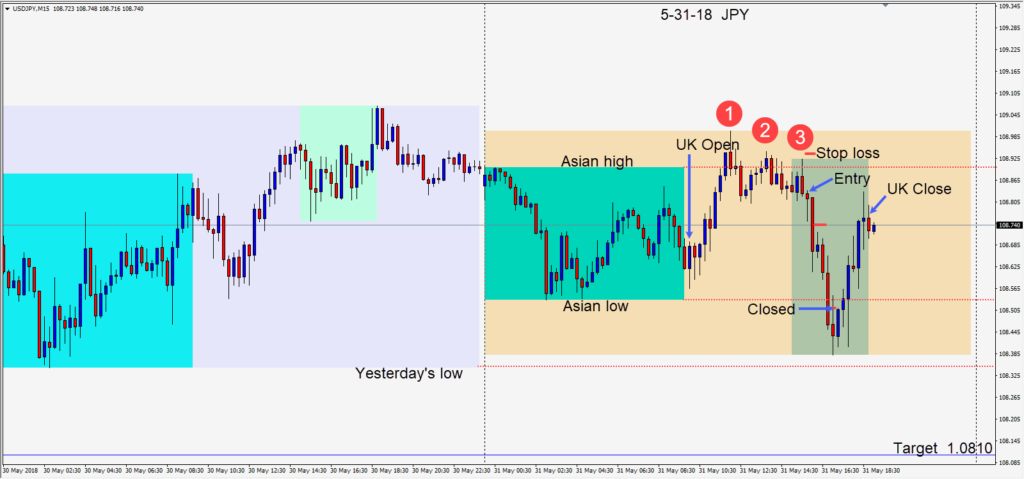

A second trade shorting the USDJPY set up for us today. Risking 13 pips for a potential 73 pips to our daily target, we entered short. The idea was to take advantage of a flight to safety. After 3 lower highs, we entered and price moved down quickly but the trade closed at our profit stop when it bounced to retest its Asian low.

Be careful tomorrow trading around the Non-Farm Employment release which historically is accompanied by extremely volatility. This has been less so this year. There is a lot going on geopolitically… be very careful trading and keep adjusting your profit stops… so as not to give back your profits.

Good luck with your trading!