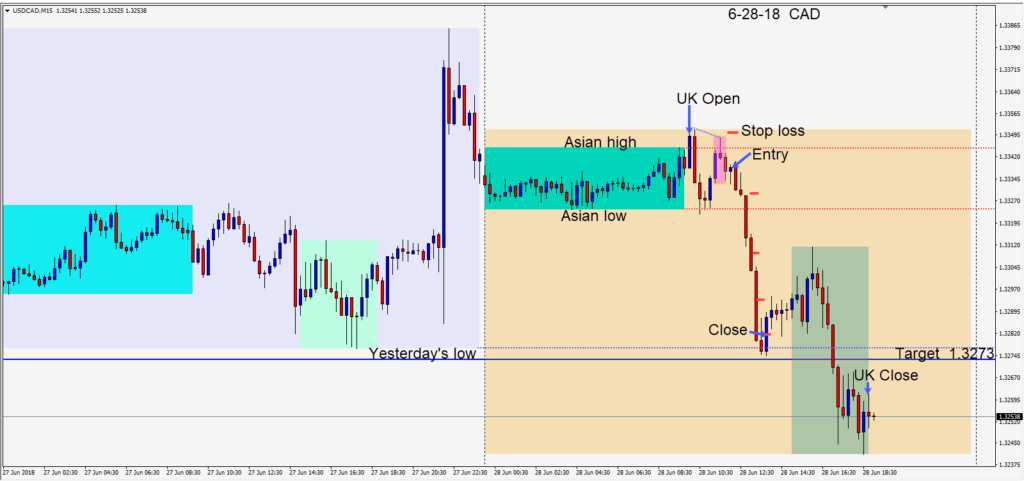

The USD was weaker today and oil traded at 3.5 year highs. After making a second lower high in the U.K. session with a reversal pattern, a short was taken on the USDCAD risking 14 pips for a potential 64 pips to our daily target. This was clearly a counter-trend trade but fundamentals, technicals and an inexpensive stop loss made the trade attractive.

The pair came down vertically and bounced at yesterday’s low taking us out just above of our daily target. With any counter-trend trade, the idea is to take minimal risk initially and get the risk out of the trade quickly as price moves in your favour. Secondly, you’re less likely to make as much on a counter-trend trade, so when price shows signs of reversing, either lock in more of your profit or close the trade.

If NAFTA talks continue to go sideways, the Canadian economy could slow substantially and the “R word” could get mentioned by the Bank of Canada. As Saudi Arabia and Russia produce more oil, the price of WTI is likely to come back down from its highs… but we will leave that one to oil traders. The 1.3400 figure hasn’t been taken out yet, but that doesn’t mean that 1.35oo isn’t a longer term target for some.

North America has two holidays next week – Monday for Canada and Wednesday for the U.S. Tomorrow may be active as we close mid-year trading.

Good luck with your trading!