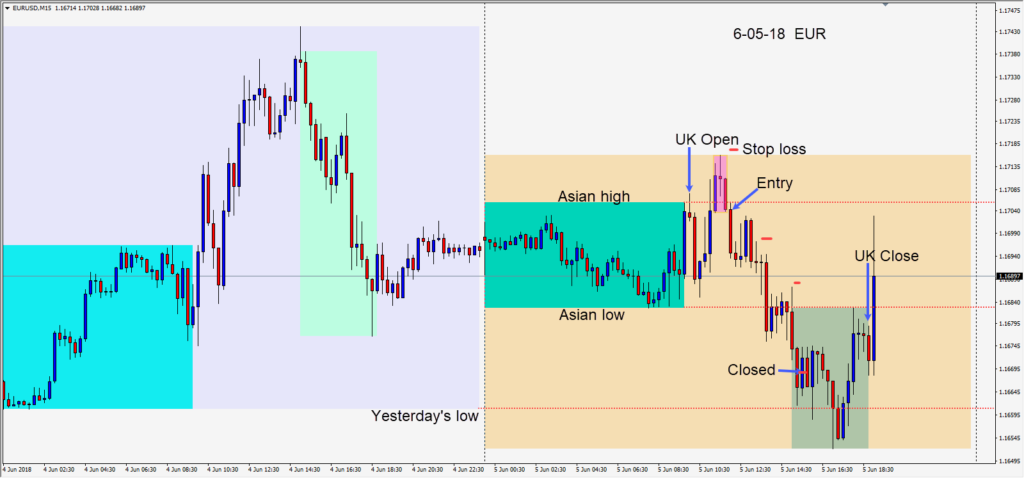

On Thursday, E.C.B. President Draghi stated that the Q.E. program will end at the end of December this year (no surprise there). The surprise for the market was that he stated there would not be any interest rate increase through the summer of 2019…and the EURUSD plummeted. This came the day following the FOMC hawkish statement that a fourth interest hike this year is on the table.

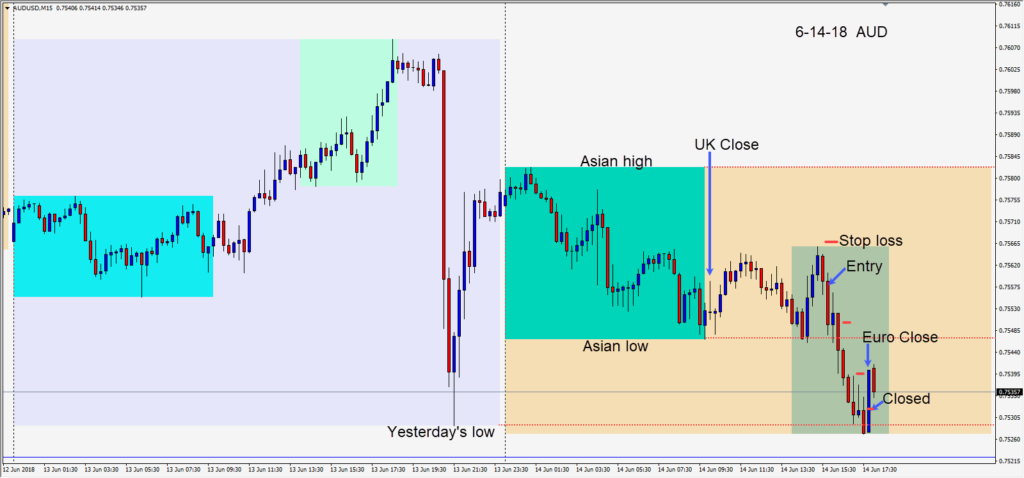

Avoiding the potential volatility from the Draghi speech, I chose to focus on an AUDUSD short… risking 9 pips for a potential 36 pips to our daily target at .7522.

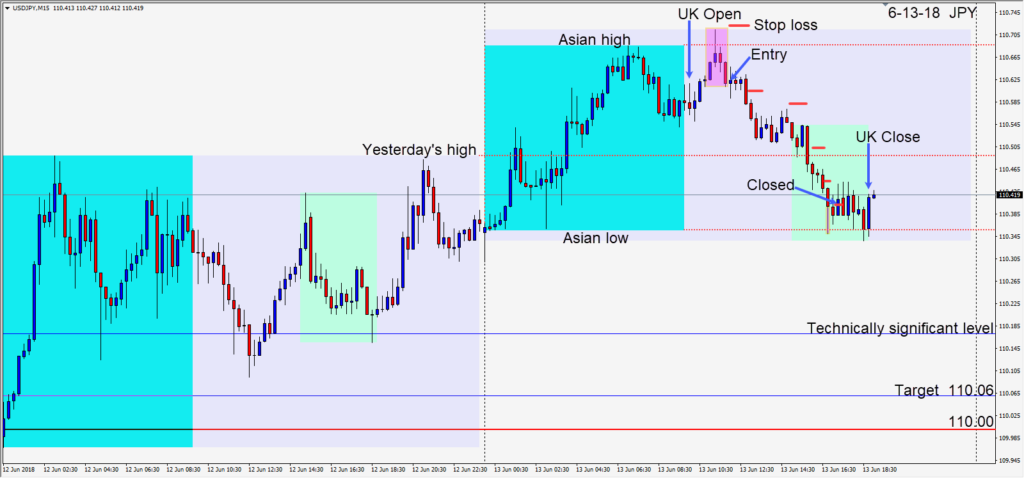

The BOJ disappointed today, but the market is very focused on the trade tariffs with China. The U.S. economy is very strong, but trade wars especially on the scale rumoured for China will not help it. I read a report today that Treasury Secretary Mnuchin has warned President Trump that the tariffs could have dire consequences. The good news is that both countries have some time to reconsider and negotiate before the implementation date of July 6th.

It’s pretty exciting out there. Always make your trading decisions on what the market is doing and showing you – not the ever-changing headlines. It’s very useful to know the market’s sentiment, but trade what you see…not what you think. Don’t be concerned about stepping aside when the signals are less clear and coming back later.

Enjoy your weekend!