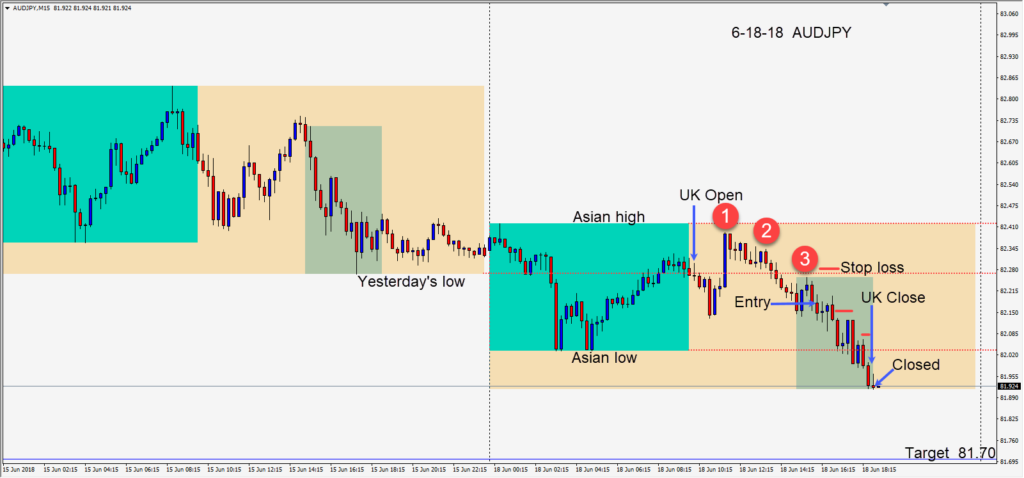

The trade war implications between the U.S. and China have the markets unnerved and moving toward safety today. With major stock indices selling off to begin the week and money flows moving toward the JPY, we chose to short the AUDJPY. The AUDJPY is a good gauge for risk appetite and today it moved down.

A short was taken early in the U.S. session as price made a third lower high…risking 10 pips for a potential 47 pips to our daily target. Price moved lower testing its Asian session low, then descended further into the London close, where we exited the trade.

The AUDUSD moved in parallel. Either trade was attractive.

There is so much going on geopolitically that the majors are likely to remain active going into the summer. The USDCAD is likely to be active this week as we approach the OPEC meeting on Friday with rumours of both Russia and Saudi Arabia wanting to increase oil production by 1.5 million barrels per day. Commodity currencies have been suffering in the face of the strong USD. Talk of trading tariffs between the U.S. and Canada are also weighing heavily on the Canadian dollar.

Good luck with your trading!