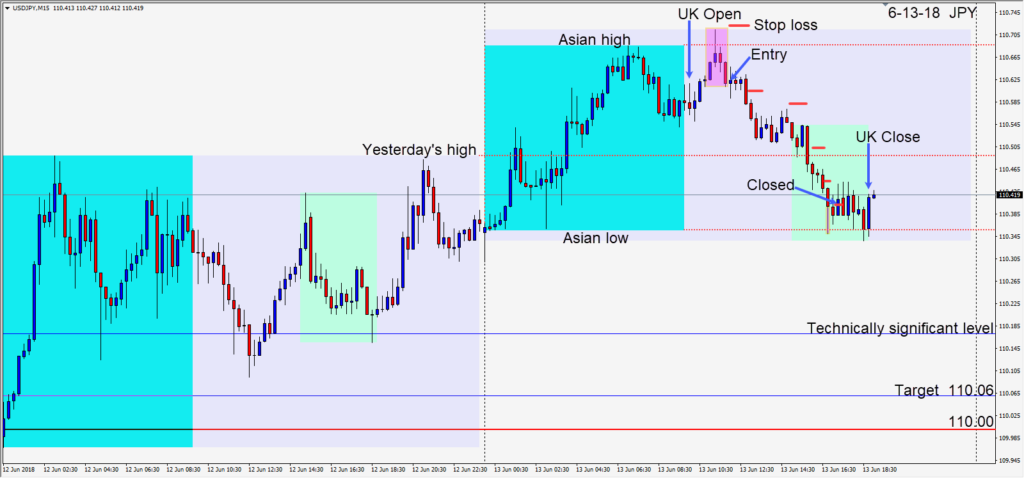

On Wednesday, well before the FOMC rate announcement, a short setup was found on the USDJPY.

After the Summit in Singapore yesterday went well, the market shifted its focus back to trade tariffs. With a pending announcement from Fed chair Powell, and the USD not showing any strength, a short USDJPY trade had potential. We risked 11 pips for a potential 55 pips to our daily target at 110.06. Price had failed to close above its Asian high and we were hoping to get through yesterday’s high and the Asian low on the way to our target. As price moved down, it bounced at its Asian low…leaving a long lower wick. We tightened our profit stop and our trade was subsequently closed as buyers entered in this area.

On Thursday the market will be listening closely to ECB President Mario Draghi… expecting to hear when the bond purchasing by the ECB will end. The market is trying to determine how soon Europe will be able to reduce its asset purchasing and move toward normalization. Any surprising signs of this being imminent will help the EUR appreciate.

On Friday the BOJ statement may be anti-climatic and in the meantime, 110.00 remains telling for the USDJPY.

Good luck with your trading!