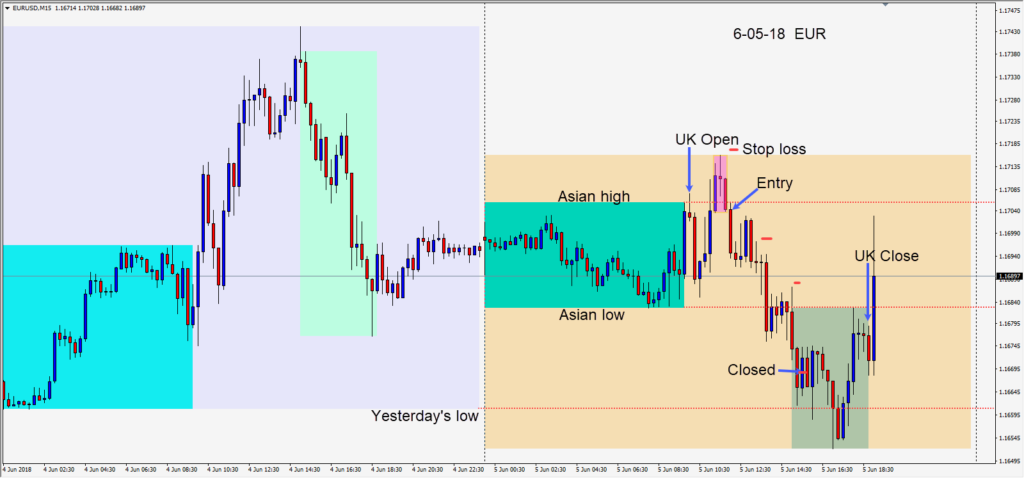

The EURUSD set up today for a very rewarding R:R as we were able to enter short risking 14 pips for a potential 100 pips to our daily target at 1.1604. The pair stair-stepped down after it failed to close above its multi-pivot. Protecting our profit in advance of the ISM Non-Manufacturing release caused our trade to be closed before the last wave down.

After the U.K. session a report that the ECB live meeting on June 14 could give us an announcement as to when they intend to stop buying bonds. This jolted the EURUSD higher. Never fight the market, but I don’t expect a lot to materialize from this. We will watch and see if the EUR takes out important technical levels or if it begins to fade again. Despite the reversal after the U.K. close, overall the range was tighter than expected today which leads me to be suspicious of the strength behind the countertrend move.

The U.S. tariffs are more a concern for the USD at the moment in my opinion. than a sudden pop in the EURUSD. Watch how price reacts at the key technical levels, keep your stops tight and protect your profits.

The RBA left rates unchanged which gave way to further selling today. The NZDUSD which tends to move lockstep with the AUDUSD most days had a very appealing entry after it failed to stay above its Asian high. The AUDUSD setup was less attractive as it was in the middle of its Asian range. Congratulations to those who traded the Kiwi.

The Canadian dollar continues to get beat up with NAFTA negotiations going sideways and oil moving lower. WTI is retesting a critical level which will be telling for the pair. The pair looks heavy above 1.3000 but if WTI moves lower and NAFTA negotiations continue to stall, we may see 1.31oo get tested again. There is a lot of CAD news going forward this week including the Trade Balance and Crude Oil Inventories tomorrow. BOC Governor Poloz will be speaking Thursday and Employment numbers are due Friday. It looks like it will be a busy pair.

Good luck with your trading!