The market has priced in a 90% probability that the Bank of England will raise the interest rate on Thursday. Expect the the GBP to be active this week in advance of the announcement, as we move into August trading. With lighter volumes price can be more volatile and seemingly appear to be erratic.

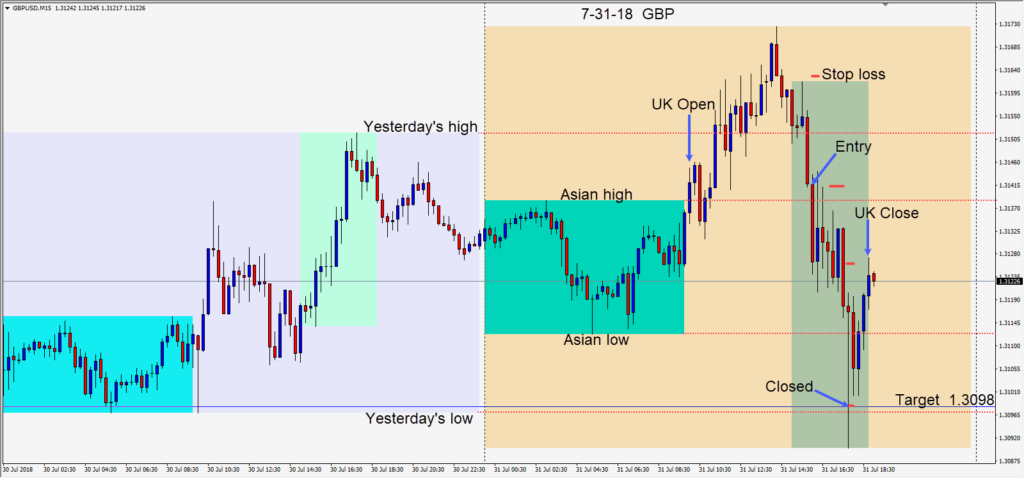

Today we waited for the first round of U.S. economic releases before taking a short on the GBPUSD. We entered with a 21 pip stop loss for a potential 43 pips to our daily target at 1.3098 with a slightly stronger USD today than yesterday. Price had clearly rolled over closing below yesterday’s high and was heading to test its Asian session high…which is retested a couple of times before moving lower. As it headed to test its Asian session low, it spiked lower… through our daily target, the 1.3100 figure and right through yesterday’s low, then abruptly pulled right back up. We closed at our daily target on the bounce upward.

Be careful on days of USD weakness as these are not likely to last in my opinion. The U.S. economy is very strong and in President Trump’s words…”the envy of the world”.

Good luck with your trading!