The markets were appearing apprehensive in advance of the Trump-Juncker meeting today regarding the tariffs between the E.U. and the U.S.

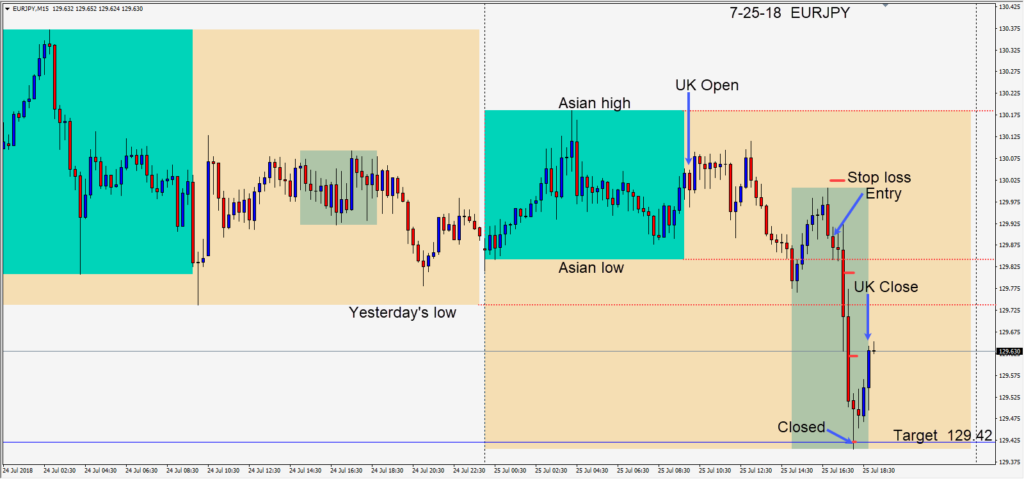

With the equity markets, USD and U.S. 10 year yield all down early in the U.S. session, the idea was not to trade the EURUSD short due to potential volatility, but to trade the EURJPY short as money flows moved to the yen. The uncertainty in advance of the meeting was not helping either the the Euro or USD.

Both the EURUSD and the EURJPY set up nicely. Risking 13 pips for a potential 46 pips to our daily target at 1.2942 we opted for the EURJPY short. We removed the risk from the trade quickly and continued to tighten our profit stop as price moved lower. In just over an hour price moved down to our target and closed our trade.

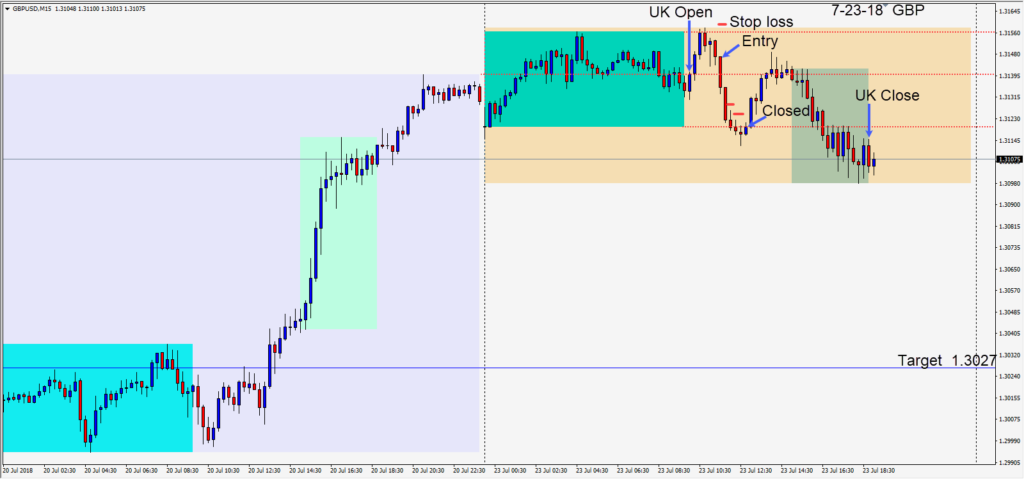

On Monday, my least favourite day to trade, a short in the GBPUSD stalled at its Asian session low for a modest return.

The news of Prime Minister May taking personal charge of the Brexit negotiations (“soft Brexit”) with the E.U. may help market expectations but uncertainty continues to weigh heavily on the sterling.

Good luck with your trading!