It didn’t take long for the major world equity markets to move down, once President Trump announced a further $200 billion of trade tariffs against China. An announcement that caused a knee-jerk reaction for both the AUDUSD and NZDUSD. Trade war concerns which had abated this week are again in focus…as the markets await China’s reaction. In 2017, China imported $130 billion of U.S. goods. The new 10% tariffs are scheduled to go into effect at the end of August.

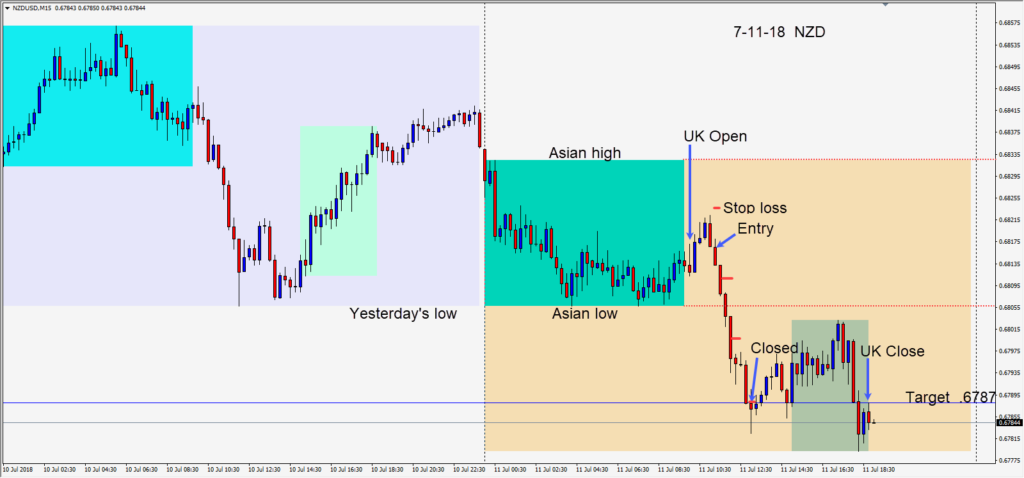

The NZDUSD set up for an attractive short early in the U.K. session – risking 7 pips for a potential 28 pips to our daily target at .6787. Price moved lower to our target where we exited well in advance of the U.S. session.

Despite significantly lower than anticipated crude oil inventories reported today, WTI dropped close to 5%. An alliance between the U.S., Saudi Arabia and Russia may be the driver for a continued move down. Libya is also talking about raising production levels.

A 25 basis point increase in interest rates in Canada today, could not prevent the USDCAD from moving higher and the 1.3000 level continues to be supportive.

In Britain tomorrow the “white paper” will be distributed and the GBP pairs will be prone to volatility as the market digests the Brexit implications.

Good luck with your trading!