The U.S. economy continues to be very strong and Fed Chair Powell this week stated that gradual rate hikes were “for now” the correct approach. President Trump’s late cycle stimulus and shift to more protectionist trade policies has helped the USD strengthen. Since President Trump has now stated that he isn’t “thrilled” with the Fed’s policy to continue raising interest rates, the USD has suddenly lost it’s upward momentum…at least to end the trading week. We will see where this goes next week as traders determine the implications and whether the USD is overvalued.

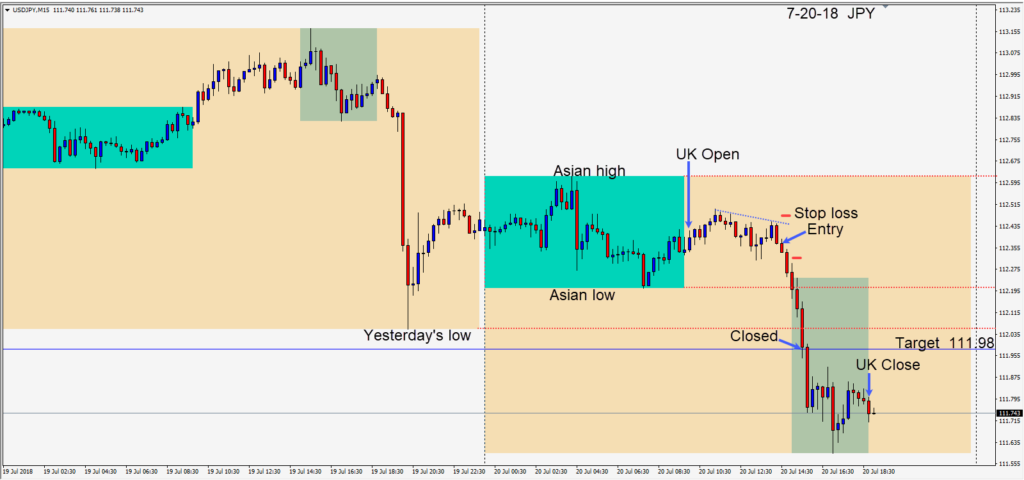

Today, following a bearish engulfing candle a USDJPY short was taken risking 10 pips for a potential 39 pips to our daily target at 111.98. As the U.S. session got underway price quickly dropped to our target and the trade was closed.

The controversial remarks from the president have for the moment prevented the dollar index from extending beyond the 95.00 level. As President Trump is not likely to put pressure on the Fed, the USD will likely continue to strengthen when the dust settles on his latest comments.

Good luck with your trading and enjoy your weekend!