The equity markets begin the trading week having put aside trade tariff concerns… at least for today. The major equity exchanges around the world moved higher, but for how long?

The USD index was relatively flat and there was some appetite for risk as equity markets and the U.S. 10 year yield moved higher, but curiously gold was also higher.

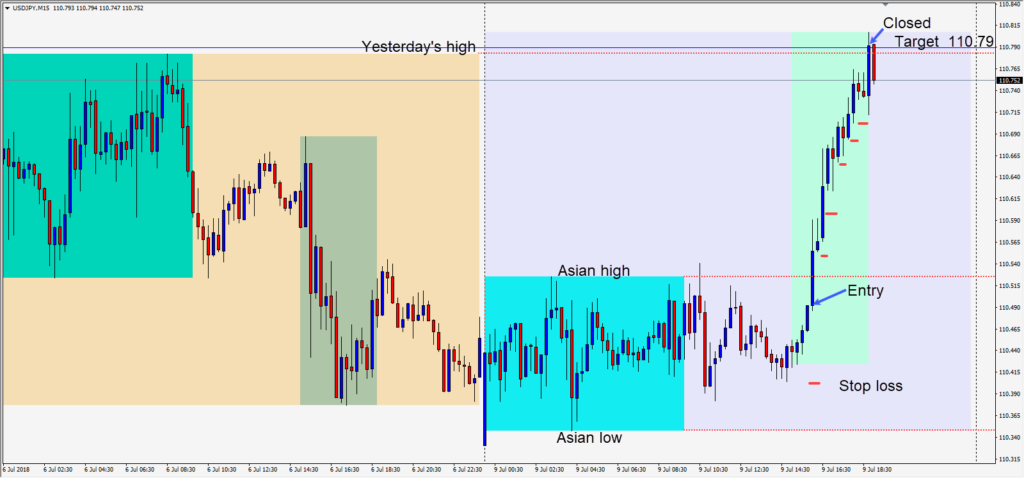

There were multiple entries across the majors today, but to play it safe, I preferred the USDJPY. An entry was taken early in the U.S. session as price moved higher – risking 10 pips for a potential 30 pips to our daily target at 110.79. Price moved to our daily target and we exited the trade at the U.K. close.

The GBPUSD moved sharply lower in reaction to the high profile resignations within the Prime Minister May’s Conservative party. The GBP pairs are likely to be very actively traded this week. Be aware of volatility as the Brexit strategy remain highly controversial and uncertain.

The EURUSD moved sharply lower today as the ECB President Draghi gave the market very little new information. Is it possible that when President Draghi steps down next year that interest rates will not have changed during his leadership?

Unlike last week, this week looks like it has the potential to be a very active trading week.

Good luck with your trading!