It’s been difficult to understand the euro strength since mid August. It is still a year away before the ECB will start normalization of its monetary policy. Conflicts continue within the euro zone and Italy has threatened to not make payments into the EU budget and may break its deficit target, then ask the ECB for assistance. Germany however, is doing very well and there is some inflation.

Today moderate USD strength emerged after a week, but money flows to the yen were apparent as the U.S. 10 year yield and equities were under pressure – in a risk off environment.

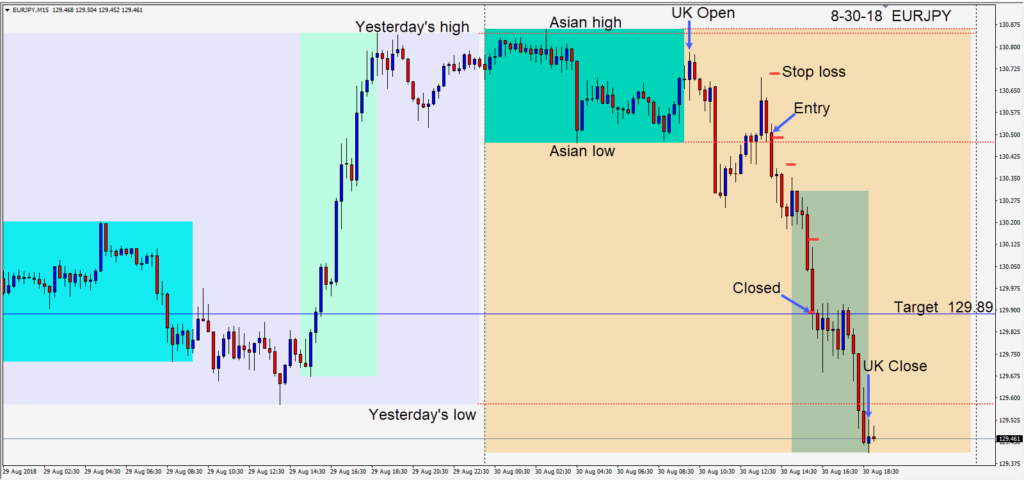

A short EURJPY setup gave us an entry in advance of the U.S. session – risking 20 pips for a potential 61 pips to our daily target at 129.89. Keeping our profit stop tight we locked in profit as the trade moved to the target where we closed the trade.

It will be interesting to see how the markets close the week in advance of the North American long weekend. NAFTA may come closer to fruition on Friday, but the market will be focused on the potential increase of $200 billion in tariffs on imports from China being implemented as early as next week.

Good luck with your trading as we close the month of August!