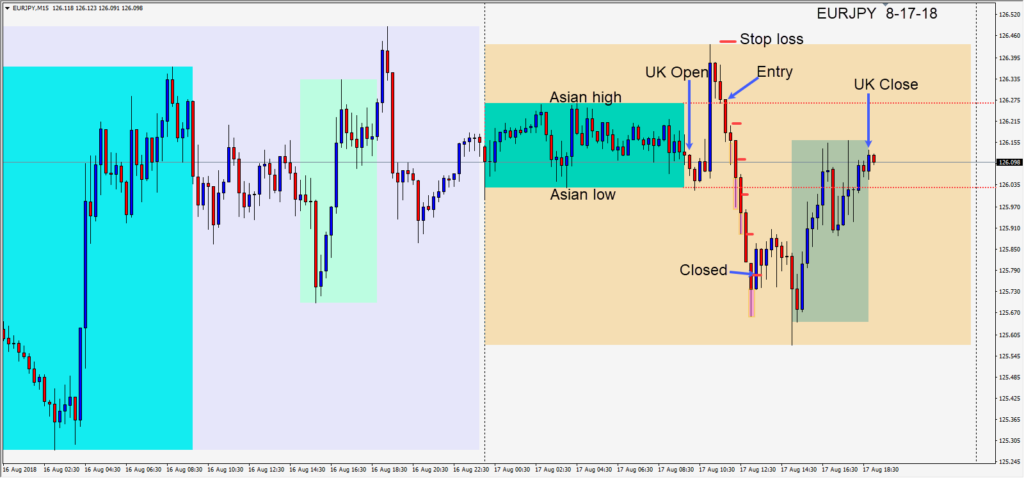

The EURUSD , EURJPY , AUDUSD and NZDUSD all moved simultaneously higher early in the U.K. session. The U.S. 10 year yield was dropping. Waiting 2 more candles confirmed that the EURUSD and EURJPY were moving down and with the EURJPY being very active recently, we risked 17 pips for a potential 136 pips to our daily target (not shown) at 1.2491. Despite a note of optimism regarding the U.S. and China planning to talk again regarding sanctions, Turkey concerns less prevalent than earlier in the week…it made sense that safe money flows to the JPY and CHF would be prudent with the uncertainty of news and “tweets” over the coming weekend. The USD has not been consistent this week and as a trader if I’m not comfortable holding U.S. dollars then I’m going to be squeamish about holding euros at this stage of the economic cycle.

A short was taken and price moved down but left notable lower wicks as it declined…indicating that buyers were entering. As price moved lower, we locked in more profit with each candle and our trade was closed as price moved up 2 hours before the U.S. open. With a weaker USD at the time, a EURUSD short was not appealing, and my thought was with money flows to safety that the EURJPY would be the better trade.

Keep your stops relatively tight, as this market abruptly turns… then turns again. A good trader protects his profits and gets the risk out of trades by locking in profit as the trade moves in their favour.

Enjoy your weekend!