The GBPUSD moved lower today during a week light on economic news drivers. The 1.3000 level gave way last week despite the rate increase in Britain. Although 1.3000 may be re-tested, this pair looks like it may be headed lower to my eyes.

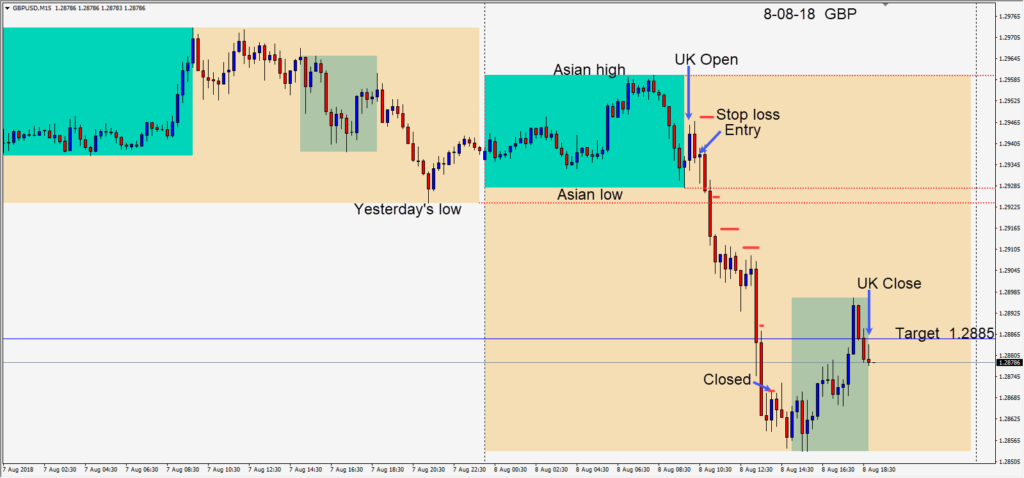

We took an early entry short as there were no economic releases for the U.K. scheduled. Risking 12 pips for a potential 50 pips to our daily target at 1.2885 and with very clear charts, the pair had downside momentum. Price tested its Asian session low before descending and moving sideways for 2 hours, then dropped and closed beneath our target. We tightened our profit stop for 2 more candles and our trade was closed.

It’s nice experience a good size move in August despite the USD going sideways the past couple of days. Some of moves may be a little exaggerated due to less liquidity and volume during this prominent holiday month, but for those of us not on holiday, it’s fun trading.

Good luck with your trading and happy holidays for those that can get away at this beautiful time of year.