It’s been very interesting watching the mighty USD fade in strength recently, despite the fundamentals of a very strong U.S. economy and rising interest rates. Some critical levels are being taken out and the oversold Euro and Sterling have begun to move up. Brexit issues, a focus on Italian debt or any number of other issues could bring the Euro and Sterling back down, but in the meantime an appetite for risk has prevailed.

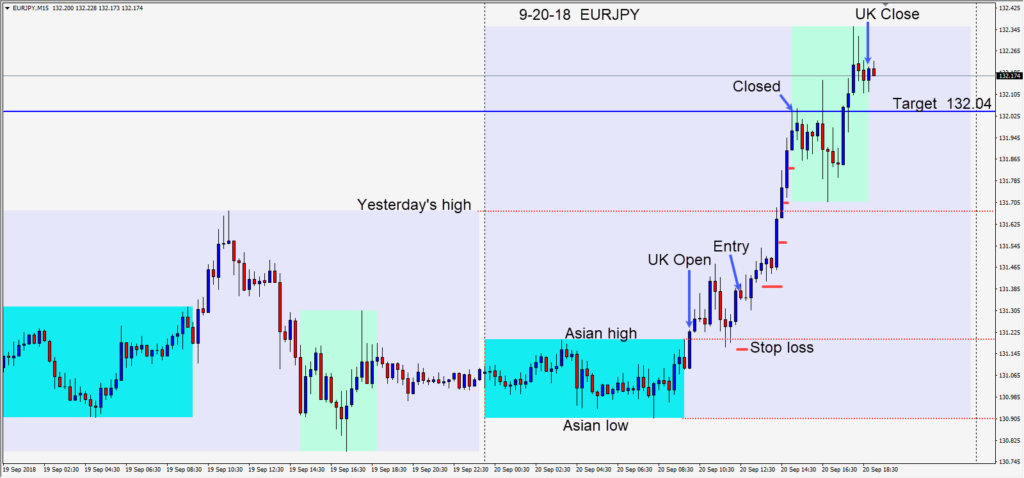

As the U.K. session got underway the EURJPY moved higher then pulled back to retest its Asian session highs, then moved higher… where an entry was taken risking 22 pips for a potential 66 pips to our daily target at 1.3204. Price continued upward and our target was realized as the U.S. session began.

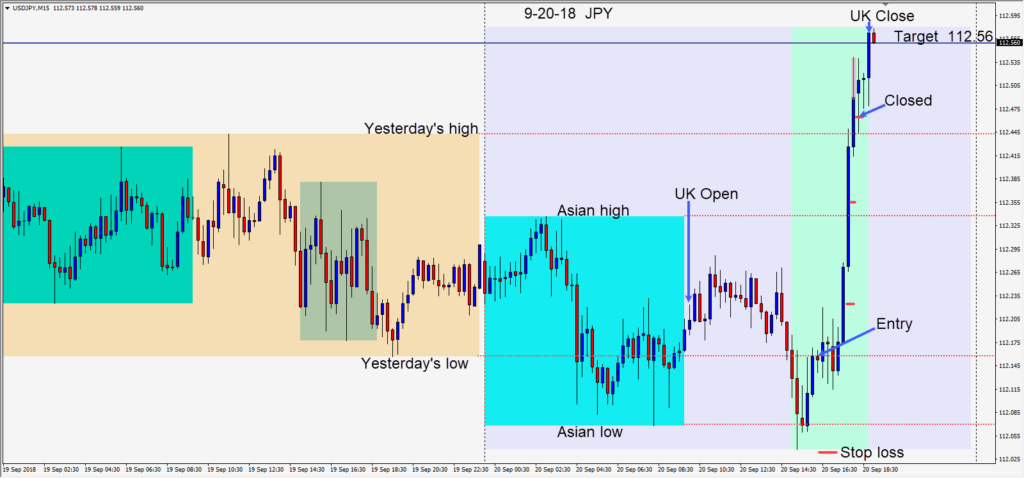

A second trade was taken today as the USD remained weak and “risk on” remained as evidenced by global equity markets. This helped push the USDJPY higher. Risking 13 pips for a potential 40 pips to our daily target an entry long was taken. Price moved up but when a long upper wick appeared, we moved our profit stop up and the next candle closed the trade. One of my students rode it right to the daily target and got an extra 10 pips with an identical entry. ( Congratulations Juerg!!!)

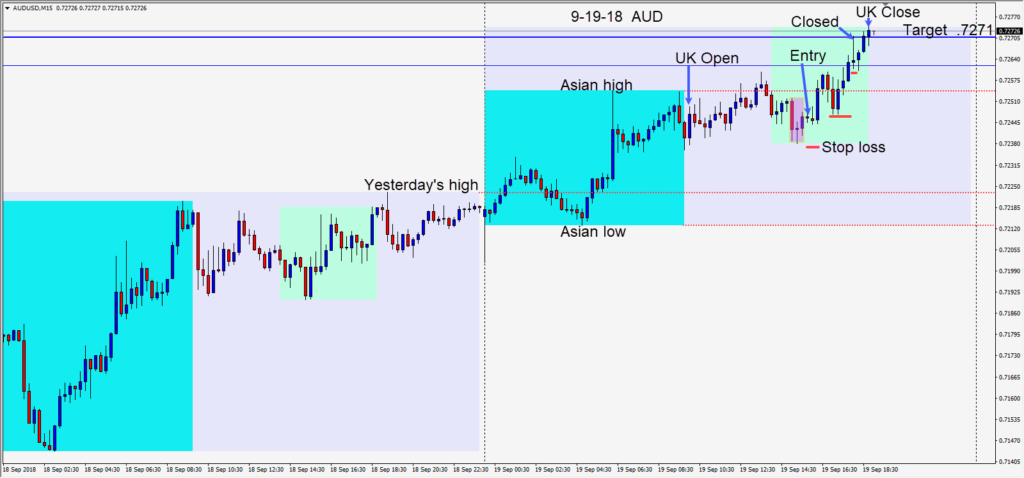

On Wednesday we took the AUDUSD long during the early part of the U.S. session risking 10 pips for a potential 25 pips to our daily target at .7271

As price moved higher we placed our profit stop at plus one pip, which held after a minor pullback for 2 candles… before price moved higher into the U.K. close.

The EURUSD, EURJPY and GBPUSD have all moved higher above technically significant levels on the daily charts. Will price retest these levels or will price continue higher? We will have to see how long this “risk on” appetite continues. Keep an eye on the 10 year yield, equity markets and USD index for some clues. Keep your stop losses tight and lock in your profits as the market moves in your favour. The potential for high volatility exists as the battle between USD bulls and bears heats up. It won’t take much to take the wind out of the sails of the EUR and GBP – which is why we trade on technicals but pay close attention to the fundamentals.

This summer President Trump said that he wants a weaker USD. He also made it clear again today that he wants the OPEC countries to lower the price of oil. .

I will be away tomorrow but back next week.

Good luck with your trading!