The market remains concerned regarding the impact of the tariffs between the U.S. and the China. There is also a concern about whether Canada and the U.S. will be able to come to agreement on NAFTA. Although headlines may indicate different deadlines for this to happen… as long as it does happen by month end or sooner, we can put this one behind us. Otherwise the CAD is in for some selling as the market believes that not only will NAFTA pass but also the Bank of Canada is about to raise interest rates again. Emerging markets are suffering and this too is reason for the market to seek safety and avoid risk. It is not a surprise with all the uncertainty and focus this week that the USD has been soft.

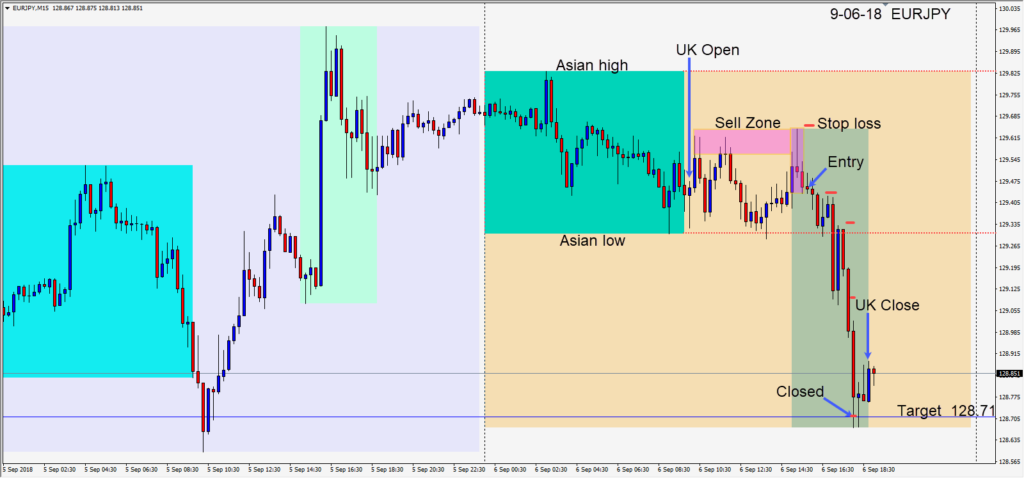

Today with equity markets all in the red and the 10 year yield also dropping, we looked to short the USDJPY and the EURJPY. The latter turned out to be very worthwhile. Risking 20 pips for a potential 74 pips, we entered short after a familiar reversal setup with a target of 128.71. Price made it’s way down to its Asian session low and moved a little higher causing us to move our stop loss down to plus one. Price then plummeted through its Asian session low, came back to retest it, and moved down quickly to our target where we exited.

This is the only day of trading for me this week. Monday was a holiday, Tuesday there were no setups with an appropriate risk reward ratio, Wednesday my modem died before the U.K session. I still prefer not to trade on NFP Fridays.

Good luck tomorrow and enjoy your weekend!