Mondays tend to be difficult days to trade. On rare occasion they can be rewarding, but they tend not to be revealing of the coming week’s bias. Lately, by being very selective, I have found fewer trades each week – partly because I’m a USD bull. The market of late has not entirely agreed with me and it’s not uncommon to see 3 bearish days in any given week for the USD. As the market has started to shift a bit away from USD strength, I’m prepared to very selectively do the same… as it’s never a good idea to fight the market.

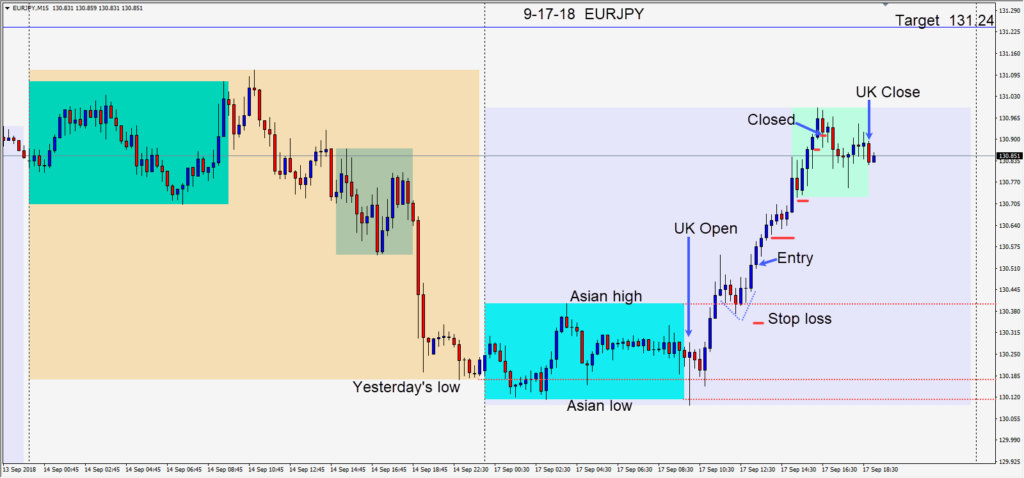

Today was a day of USD weakness, but not one of “risk off”. There was a fairly uniform move against the USD today and the EURJPY was preferable to me over the EURUSD because it had pulled back after breaking above its Asian range. The EURJPY offered an entry with a small stop loss of 16 pips for a potential 72 pips to our daily target at 131.24. Price moved up into the U.S. open and without any U.S. economic news releases, price moved higher, but was unable to climb above the 131.oo figure.

The EURJPY tends to be a very active pair and not nearly as erratic in its moves now, as it has been historically. It certainly is worth a look.

Mario Draghi will be talking twice this week, so trade accordingly. Any positive news regarding Brexit can cause large up moves for the GBP and EUR. The trade tariff threats continue between the U.S. and China… which some days the market seems more focused on than other days. Australia and Japan both have monetary policy statements this week. It will be interesting to see if Britain can continue its recent positive economic progress.

Good luck with your trading!