The markets have become volatile in October once again. It was a shortened trading week in North America and equity markets were making the headlines as they began to sell off. As U.S. yields continue to rise, the market participants looking for a safe return tend to prefer bonds over dividends when the returns are comparable. As borrowing costs increase with rising interest rates, this too affects the equity markets negatively.

If we also consider the U.S. versus China trade tariff impact, E.U. versus Italy debt and spending concerns, amiable or acrimonious Brexit, President Trump criticizing the Federal Reserve for doing its job, pending U.S. mid-term elections, oil surplus or shortage, pending election in Germany etc. one can surmise that the market participants have some issues to consider. The economic fundamentals remain extremely strong for the U.S. economy, although the USD had a tough week it ended with some strength today… as did the U.S. equity markets. Had the downturn continued to the close, next week may have seen a continuation and a downward spiral. Fortunately, we had a bounce today to end the trading week.

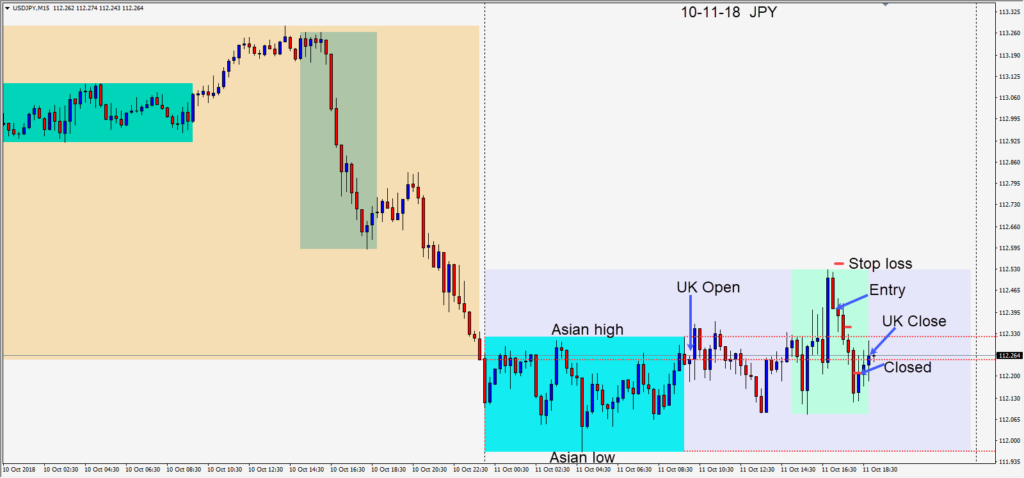

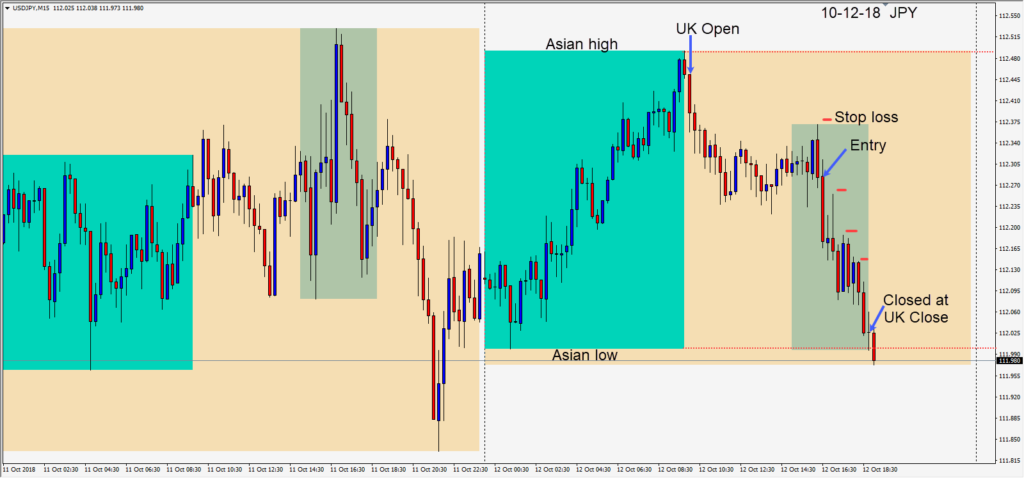

I have been very cautious this week trading only the USDJPY on Thursday and again today, but the returns were very modest.

On Thursday with the USD was very weak and with equity markets selling off, we entered short risking 14 pips for a potential 70 pips to our daily target at 111.70. Price moved down sharply but bounced upward before making it to session lows and closed the trade.

On Friday, a similar trade risking 11 pips for a potential 57 pips to the same daily target at 111.70. This trade we managed to ride a little further and exited it at the U.K close.

Next week should be another interesting one. Keep your stop losses tight and lock in profits. The potential for volatility remains very high which can be very satisfying if you are on the right side of it. If you’re not, a strategically placed stop loss is your friend and will protect you from potential catastrophic damage.

Good luck with your trading and enjoy your weekend!