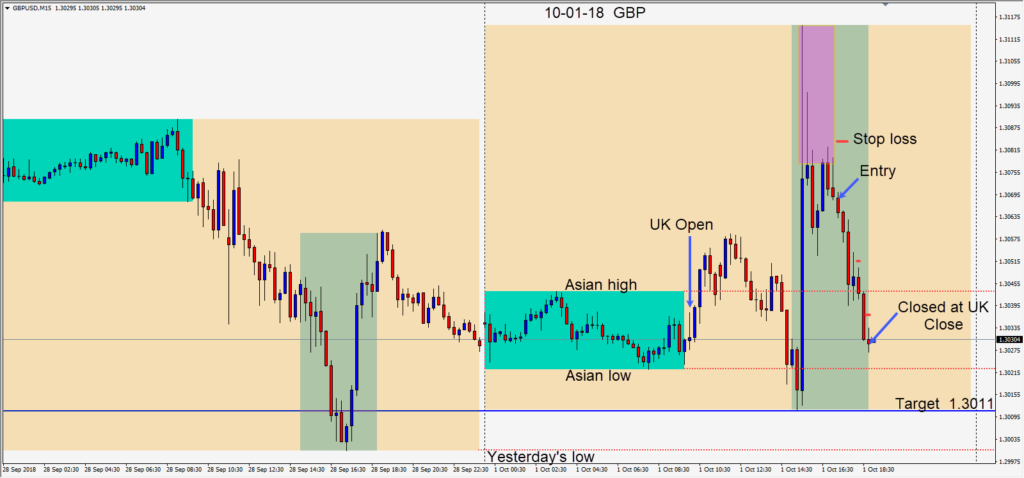

As Brexit continues to weigh on Sterling, and PM May continues to struggle in finding support, a short setup was found on the GBPUSD. After lower highs appeared in the U.S. session overlap, a short was taken risking 16 pips for a potential 57 pips to our daily target at 1.3011. Price moved vertically down pausing and retesting its Asian session high before pushing lower into the U.K. close where we exited the trade.

It may be a difficult few days for the GBP as British politics continue to weigh on the pair. Ultimately Brexit will get worked out like NAFTA – now known as USMCA. Sterling will remain potentially volatile in the meantime, but at this juncture, I’m more comfortable finding short setups with tight stop losses.

We have entered the last quarter of 2018 and it will be interesting to see if USD strength will prevail. Italian politics have the potential to drag the Euro lower. The Canadian dollar is benefitting today from the new trade agreement and the current high oil prices. Australia and New Zealand remain vulnerable to China’s slowing economy. We will soon see what the market thinks.

Good luck with your trading!