The market has not offered many trade setups that I have wanted to participate in the past couple of weeks. The ones that have been appealing have produced less than they usually would.

Today the market seemed to align itself once again with some moderate USD strength in the majors with the exception of the USDJPY.

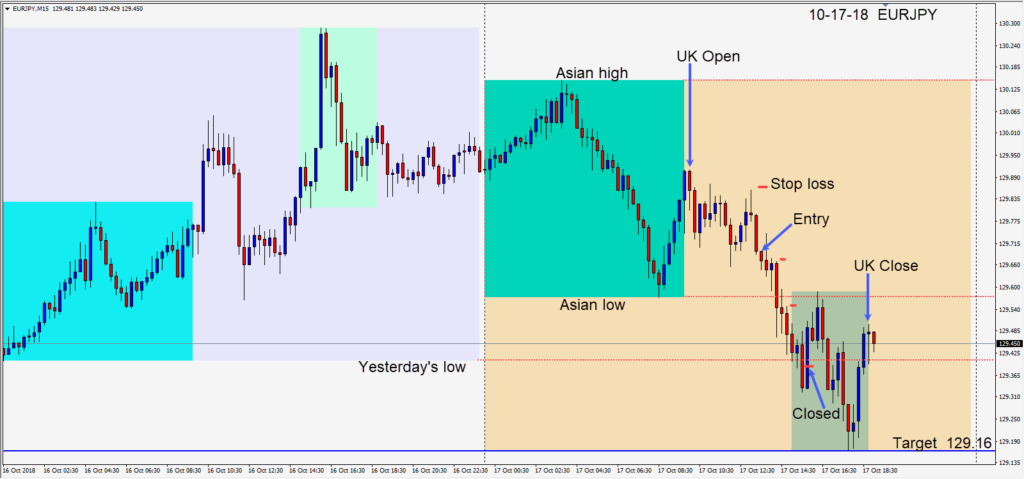

As the the EURUSD weakened and the EURJPY weakened in parallel fashion, my preference was to trade the EURJPY which tends to move further most days. After going sideways for the first 3 hours of the U.K. session, it moved down making a familiar 3 candle reversal setup. We entered short risking 19 pips for a potential 52 pips to our daily target at 129.16. As price moved down, it tested and retested its usual areas, namely its Asian low and yesterday’s low. As it began to move up from closing below yesterday’s low, we closed the trade and missed the final wave down to our daily target.

Many new traders find it difficult to not trade but it’s important to keep in mind that there are periods when the market is extremely generous and times when it is not. Neither last for long periods, but successful traders know what makes them comfortable when they see it and what makes them sit back and resist taking less convincing trade setups. Politically and economically the market has a lot to digest at the moment. It has been giving numerous conflicting signals fundamentally of late, which is making trading slower than usual and the charts less clear. Be patient and keep your stop losses tight and don’t be fearful or greedy.

Perhaps the FOMC meeting today will give the USD some added strength.

Good luck with your trading.