The FOMC meeting yesterday confirmed that the U.S. economy continues to be very strong and the concern centers on how many more rate increases will be necessary to strategically slow it down.

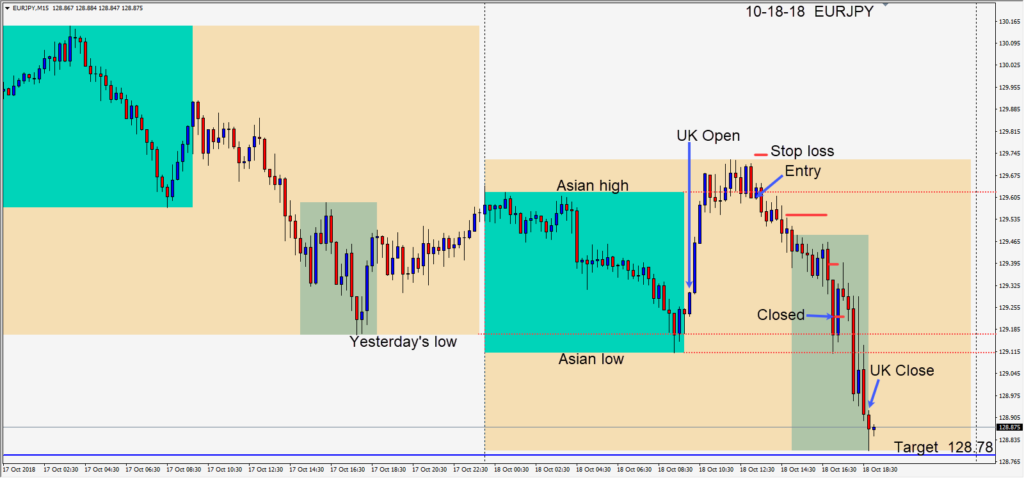

Today the EURJPY spent some time stay above its Asian high but ultimately failed and an entry was taken risking 14 pips for a potential 82 pips to our daily target at 128.78. Price slowly moved down in advance of the U.S. open and we protected ourselves by moving our stop loss to a profit stop. Price continued down to test yesterday’s low and its Asian session low before bouncing above yesterday’s low where we exited the trade.

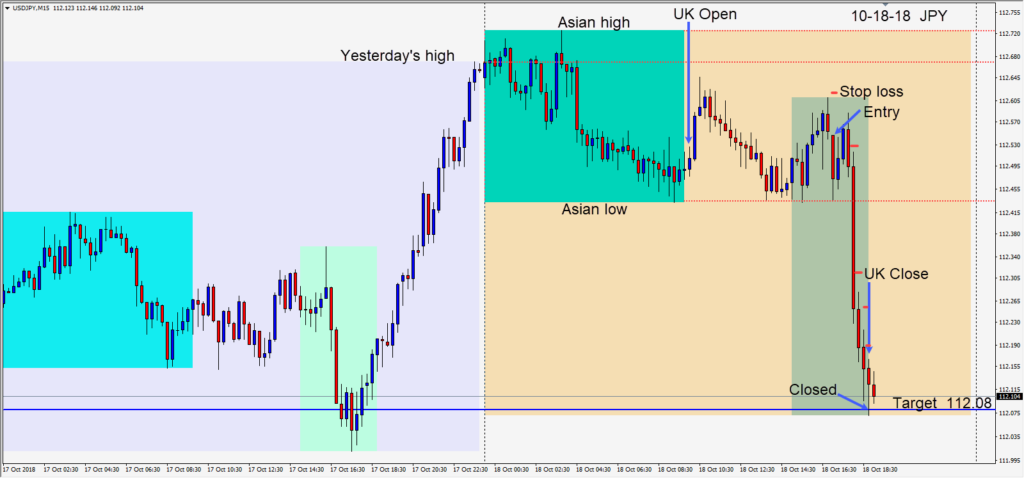

Much like yesterday despite a stronger USD versus the majors, it lacked strength versus the JPY. As the USDJPY made a second lower high for the session, a short was taken risking 8 pips for a potential 46 pips to our daily target at 112.08. Price moved down tested its Asian session low and briefly bounced making a third lower high for the session before plummeting and reaching our target.

Although talks between Brussels and London are sounding more positive, the GBPUSD has continued lower and a close below 1.3050 is technically bearish. A close for the EURUSD below 1.1430 would also be technically bearish. News relating to an amiable and workable Brexit can potentially make both pairs jump considerably, so any short trades would be well advised to have tight stops.

It’s nice to see multiple trade setups again.

Good luck with your trading!