The USD has been stronger the past two days. ECB President Mario Draghi gave the market very little new information today and reiterated the obvious Brexit and Italy concerns weighing on the Euro. Equity markets sold off heavily yesterday and are attempting a recovery today.

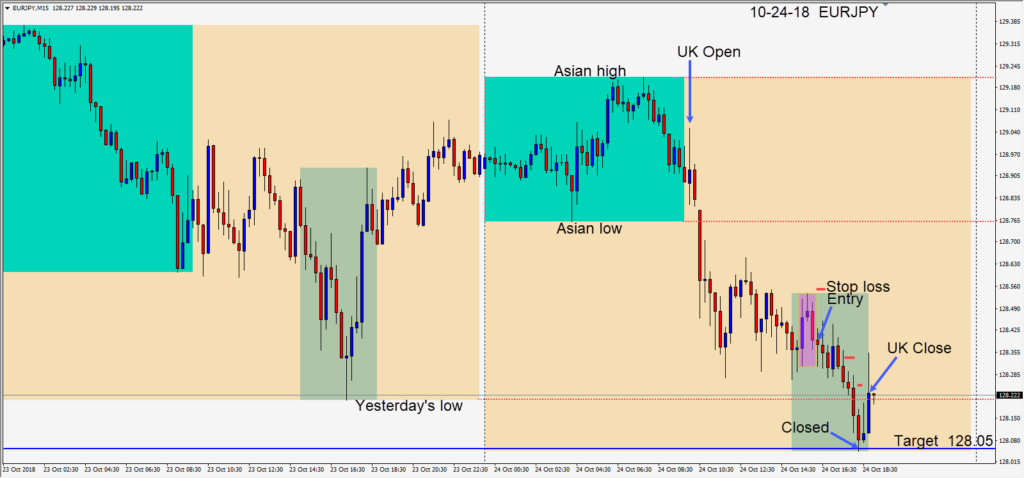

As fear entered the markets yesterday we chose to short the EURJPY after an early reversal setup in the U.S. session risking 16 pips for a potential 34 pips to our daily target at 128.05. Price made its way lower before the London close to our target where we exited the trade.

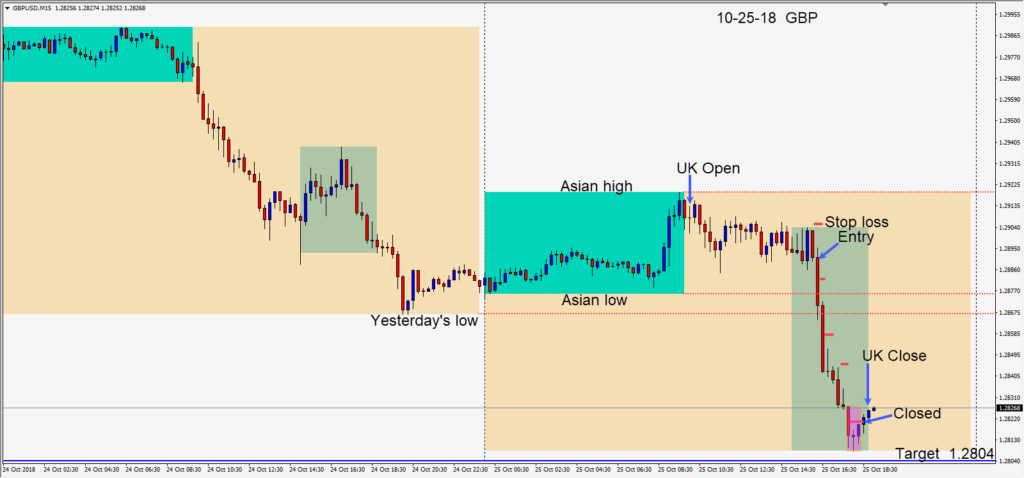

Today the GBPUSD made a series of lower highs and after making another lower high early in the U.S. session, we went short risking 16 pips for a potential 86 pips to our daily target at 1.2804. As price moved abruptly down, we locked in profit. This pair is potentially very volatile due to Brexit headlines, so it’s best to enter with small stop losses and keep locking in profit as the pair moves in your direction. Price didn’t make it to our daily target but we gave it a couple of extra candles to try, before the market took us out of the trade.

There are so many macro events occurring in the world at the moment, that it is no surprise that trading is more erratic than usual. It will be interesting to see where the equity markets close the month of October. They remain a good gauge for risk sentiment at the moment – better than the 10 year yield currently.

Good luck with your trading!